F- Facebook

A- Apple

A- Amazon

N- Netflix

G- Google

Many people believe that Microsoft should be included in this league as well. They are, however, referred to as the “Big Five.” This moniker is given to the five largest and most dominant companies in the IT sector in America. They are among the most valuable public companies globally and have a good share in market capitalization.

They just released their quarterly earnings and they’re very interesting. Let’s dive into a brief analysis of these reports.

Apple

Can you guess what Apple’s revenue was for the January to March Quarter? $20 billion? $5o billion? $75 billion? WRONG! It’s $90 BILLION.

Apple had a year on year growth of 54% for this quarter. Out of this revenue, international sales accounted for 67% of the total.

None of their segments struggled to deliver but there’s always a leader. And this time it was iPhones. It stood out because of the revenue it generated, which could be due to the launch of new iPhone models in the previous quarter. Services also contributed a significant amount, which includes Apple tv, iTunes, app store etc.

In April 2021, Apple announced that they’re releasing new products and services to be available in Spring of 2021, They all sound very appealing: iMac, iPad Pro, Apple tv 4K, Air Tag (it’s a new product to keep track of your items and helps in finding them if they get lost) and Apple Podcast Subscriptions. The question is, will these products help the company keep up with this quarter’s earnings?

I think people misunderstood the meaning of “an apple a day, keeps the doctor away”

Have you noticed, that when you search for something or look for a product on a site, you end up seeing ads similar to that while scrolling through Google or Facebook? That is what helped Facebook earn $26 billion! That’s a 46% rise in revenue year on year for them.

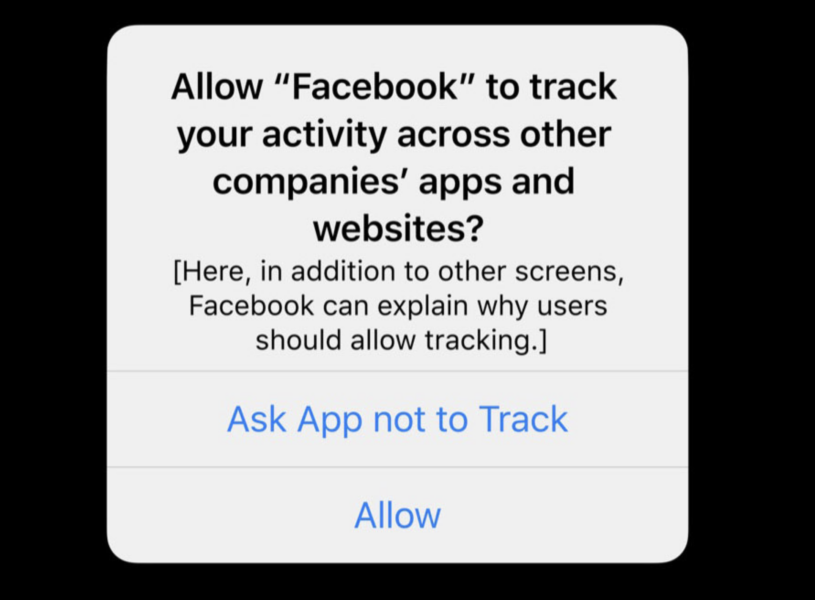

This revenue growth was achieved by a 30% year over year increase in average price per ad and a 12% increase in the number of ads delivered. And their profits nearly double to $9.5 billion! The iOS 14.5 update might create some uncertainty for fb. Introducing the newest dish in Tim Cook’s kitchen, drum roll please, App Tracking Transparency. This means, users will be asked “can Facebook track your activity on other apps and websites” and if you say no, then Facebook looses. And if you say yes, they win. For Apple, it’s privacy first. But do their users think the same?

FB now has 3.5 billion active users across all its apps ie. Instagram, Facebook and WhatsApp. That’s half of the world’s population, just think about their reach…

Google (Alphabet)

If these blockbuster revenue’s weren’t enough, Google’s quarterly report exceeded expectations. Their net income almost tripled to $17,930 billion and their revenue rose 34% year on year. There’s definitely a pot of gold at the end of the rainbow for Google, as revenue from Google cloud rose to $4 billion (46% YOY).

Out of a whooping $44.6 billion revenue from advertising, Google search was the main contributor with almost $31.9 billion (30% YOY). Have you noticed double ads on YouTube before starting a video? As you watched vlogs, how-to videos, gaming videos, pranks etc., they earned $6.01 billion from YouTube ads, a 49% surge compared to the year before.

Google might feel pressure from Apple to introduce a similar privacy update in its android phones. This will dent their ad earnings. As things around the world get better (excluding India), things are starting to reopen and people have started going back to schools/ offices, which leads to a decline in the time they spend surfing the internet. Which, again, will reduce Google’s ad revenue. We can only watch what’s in store for Alphabet now…

Amazon

Up and up and up

It’s no secret that Amazon has emerged a winner from the pandemic. The e-commerce giant only gained more importance in the midst of the pandemic. Their sales soared 44% year over year, amounting to $108.5 billion. Their net income more than tripled to $8.9 billion, in comparison to 2020. They’ve been doing exceptionally well in international markets as their revenue surged 60%

Amazon delivered their products with great efficiency, as they have more than 10 million items available for free one-day delivery, coast to coast in the US. In their attempt to contribute to prevent climate change, Amazon partnered with Mahindra Electric in India to include EV’s in its delivery fleet.

Jeff Bezos also wished their kids, Prime Video and AWS, 10 and 15 years of being a part of the Amazon family. “As Prime Video turns 10, over 175 million Prime members have streamed shows and movies in the past year, and streaming hours are up more than 70% year over year.”

They have been doing well in both the sales and service sector. Out of their total revenue, Sales accounted for 53% and services 47%. Amazon’s upward trend continues, despite the Covid situation improving. Could it be because people are used to ordering everything, including groceries, at home, or because they find it more convenient?

Faang’s earnings, overall, were nothing short of flabbergasting. Analysts tried to estimate their earnings, but didn’t quite get there. It’s a tricky job with coronavirus and what not. The market is volatile and unpredictable. They measured the risks, economic policies and recovery, people’s habits, and everything you can think of. But these companies still out-performed their estimates. No one knows when this will peak or suddenly drop…

Leave a comment