If you look at the graph below, investments by Venture Capitalists (VCs) were pretty low. Although it did increase from less than $1 billion to $4 billion, it was much less than $130+ billion in the US (source: PitchBook).

There were barely four or five main VC funds streams in India a decade ago. And they weren’t taking big risks, they stuck to safe bets. Some businesses that stood out got funding (like- Flipkart, Ola, Paytm etc.) but most of them were unable to catch the investors’ eye.

Why were they not investing in India?

What happens when VC’s invest in a company? They look for returns. Usually returns can be availed by an increase in the valuation of the company or by taking the company public. In India, the startup landscape wasn’t very attractive earlier. Formal valuations weren’t many, there were barely any unicorns and many companies ran in losses or were making little profit.

Going public wasn’t easy because of all the documentation. Other than that, there was a lot of apprehension in the market. Buying stocks on loss-making companies was an extremely risky and unconventional investment, so investors avoided it. All of this didn’t make an IPO very exciting so the companies preferred to stay private. Which wasn’t attractive to VCs.

Things are very different now. The Indian startup environment is thriving and doing extremely well. There has been a wave of IPOs this year, with a lot of startups debuting- Nykaa, Zomato, CarTrade, Paytm, Delhivery and the list goes on… Many startups have also achieved unicorn status! We can see old startups growing and new ones emerging.

Covid has definitely been a factor in all of this. It speeded up the process of shift from offline to online sale of goods and services. Brick-and-mortar stores suffered, but at the same time online retailers scaled up their operations significantly. Earlier, online learning didn’t have such a big market. Now, since everything is online, EdTechs have a much bigger audience and have used this to their advantage. Tech companies adapted to virtual workspaces very quickly and used the pandemic to make supernormal profits. Digital advertising companies (Facebook, Instagram, Twitter) got creative with new features and some of them became very popular. The e-commerce industry branched out into fashion, grocery, makeup because Covid accelerated the shift to e-commerce. OTT platforms (Netflix, Disney+, Amazon Prime) had a blockbuster year!

Such an increase in investment options has given investors in India the courage to place bets. Moreover, with these bets paying off, their risk appetite is increasing. This is probably why Indian startups attracted $16.9 billion of VC funding in 2021, second only to China in the Asia-Pacific (APAC) countries. (source: ET)

So which start-ups were actually successful in attracting VC funding, using it efficiently and providing the VCs with an opportunity to exit? You may know most of these companies as home brands instead of start-ups. Let’s see how many you can identify!

Flipkart

Flipkart is a popular e-commerce marketplace, competing with Amazon in India. It was founded in October 2007 by Sachin Bansal and Binny Bansal, former Amazon employees. In May 2018, US retail chain Walmart won a bidding war with Amazon, which led to them acquiring a majority stake in Flipkart (77%) for $16 billion! They have raised money via various VC firms through the years. They received $1 million in 2009 from Accel India. This was followed by 2 rounds of funding from Tiger Global- $10 million in 2010 and $20 million in 2011. It’s safe to say that this funding was well used since their sales increased from ₹40 million in 2008-09 to ₹200 million in 2009-10 to ₹750 million in 2010-11! Most recently, they raised $3.6 billion in a mega-round of fundraising from multiple investors. To give back to the startup ecosystem in India, Flipkart has set up its own corporate venture capital fund to invest in early-stage startups in India. Flipkart Ventures was a $100 million fund when it was first announced in 2019. (source: Your Story)

Zomato

Zomato was founded in 2008, as Foodiebay, by Deepinder Goyal and Pankaj Chaddah. It’s an Indian multinational food delivery company present in more than 10,000 cities around the world. They have made themselves known for their skills in digital advertisement (an example is their latest ad, above). They raised approximately $16.7 million from Info Edge India, giving them a 57.9% stake in Zomato. They raised money from many VC firms over the years including Sequoia Capital, Vy Capital, Ant Financial (Alibaba’s payment affiliate) and Kora. In February 2021, they raised $250 million from five investors (Kora- $115 million, Fidelity- $50 million, Tiger Global- $50 million, Wave- $20 million, Dragoneer- $10 million) to give them a whopping valuation of $5.4 billion! This comes after their acquisition of Uber’s food delivery biz. They proceeded to debut on Indian stock markets on 22nd July, after their IPO was oversubscribed 38 times. (source: Techcrunch)

Byjus

Byju’s is an EdTech company that you’ve probably stumbled upon while looking for solutions to NCERT exercises or to understand the Pythagoras theorem. For that, you can thank the couple Byju Raveendran and Divya Gokulnath for co-founding the company in 2011. They have acquired a lot of companies from around the world. Their acquisitions include US-based Osmo (maker of educational games for children), WhiteHat Jr (known for coding, math and music classes), Aakash Educational services (known for JEE preparation), Toppr and Singapore based EdTech Great Learning. By 2019, Byjus has raised nearly $785 million from various investors (Sequoia, Chan-Zuckerberg Initiative, Tencent, Soifina etc.). In June 2021, they raised $340 million from investors like Blackstone and UBS Groups. This gave them a valuation of $16.5 billion, beating Paytm ($16 billion) as India’s most valuable startup and Yuanfudao ($15.5 billion) as the world’s most valuable EdTech! In September’20, they replaced Oppo as the title sponsor of the Indian national cricket team. That’s kind of a big deal.

Nykaa

Nykaa is the go-to online marketplace for makeup products. It was founded by Falguni Nayar in 2012 and deals in beauty, wellness and fashion, with an e-commerce and brick-and-mortar presence (click here to read Falguni Nayar’s success story). Nykaa has raised money through several rounds of funding. They achieved unicorn status (valued at $1.2 billion) in March’20 after raising ₹100 crore from Steadview Capital. This was followed by another round of funding by Steadview Capital in May’20, to raise ₹67 crore! Alia Bhatt and Katrina Kaif have also invested disclosed amounts in the company. In their most recent round of funding, they raised money from Fidelity. Now, they have plans to go public and have filed their DRHP with SEBI. Investors are waiting… (source: financial express)

Paytm

Paytm Karo! How many times have you heard that? Paytm is a fintech company that has become popular for digital payments. It was founded in August 2010 by Vikay Shekhar Sharma with an initial investment of $2 million. The pandemic has definitely aided their growth as it provides a contactless payment option. Their first round of investment was in October 2011 when Sapphire Ventures invested $10 million. In May 2017, they received their biggest round of stake by a single investor (SoftBank), which welcomed them to the Decacorn club (with a valuation of $10 billion). They gained the confidence of big VC firms. In August 2018, Berkshire Hathaway invested $356 for a 3%-4% stake in Paytm. In 2019, they raised $1 billion in a successful round of funding. They are currently valued at $16 billion. In May’21, they announced their plans for an IPO by filing a DRHP. They are aiming to raise around ₹21,800 crore ($3 billion) by IPO, which could be the largest IPO ever in India! (source: Techcrunch)

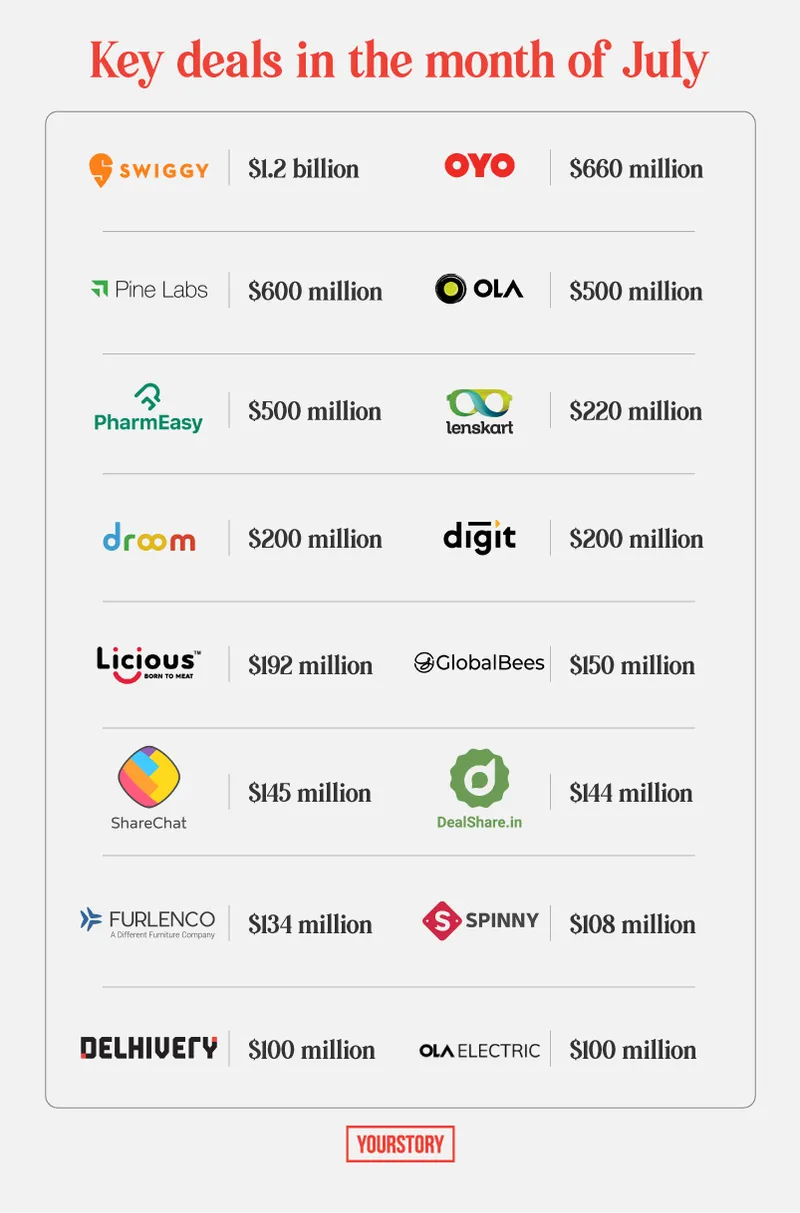

These are just 5 out of many startups that have received funding and changed the VC investment atmosphere in India. Other firms include Mobiqwik, Boat, Oyo, PhonePe, Unacademy, Ola, Delhivery, PharmEasy and the list goes on. Talk about the positive impact of Covid… The VC funding has changed rapidly in the past few months. They have just started to realise the true potential of Indian startups. Funding will provide them with the money for expansion as well as a morale and confidence boost. Everyone has high expectation for H2Fy22 after a successful H1FY22 in terms of VC funding…

Leave a comment