If you feel like you’re out of energy, you’re not the only one. The world is going through an energy crisis right now affecting India, China, European countries etc. Solar power and other forms of energy have started gaining popularity, fossil fuels are still very much in the picture. Shifting from fossil fuels to greener sources of energy isn’t an overnight process. Which is why a large percentage of the energy needs are still met by fossil fuels.

The situation is similar, yet very different in various countries. Here’s what’s common: The countries aren’t able to generate enough electricity, prices of fossil fuels are to the moon and it’s affecting post-pandemic recovery. Let’s take a look at what the countries are going through, starting with India.

Coal accounts for 74% of India’s electricity generation needs (source: The Ken). On October 1st, the 135 power plants of Asia’s third largest economy had an average of just four days of coal stocks, according to India’s power ministry. Coal-mining areas faced heavy September rains, which hit the production and delivery of this essential fossil fuel. The plants themselves had failed to stock up before the monsoon season. It also happened to be when India raised natural gas prices by 62%. While that’s nothing when compared to Europe’s 500% price rise, think about its impact on fuel, cooking gas, overall food inflation etc. A series of unfortunate events…

This shortage has led to power cuts and blackouts in many states. Rajasthan, Bihar and Jharkhand have been experiencing power cuts lasting up to 14 hours! Maharashtra shut down 13 power plants and urged the residents to use electricity judiciously. 3 plants in Punjab halted productions, necessitating scheduled power cuts. However, this shortage isn’t because of a shortage of domestic coal production at all!

The current crisis isn’t a result of shortage of coal mining capacity at all. Rather, it has been caused due to inadequate planning, forecasting and stocking of coal by power and energy generators. The heavy monsoons further caused flooding, thus impeding the dispatch of coal.

As compared to previous years, it’s not very different. The same factors are in play year after year. Why, then, are there threats of blackouts and depleting coal resources unlike previous years?

You see, India isn’t a major producer of coal. They have definitely ramped up production over time, but it’s still not sufficient to meet the needs of such a large country. To bridge the gap between demand and supply, they depend on imports.

There are two major exporters of coal- Australia (the world’s largest exporter of metallurgical or coking coal) and Indonesia (the world’s largest exporter of thermal coal). Meanwhile, China is the largest importer of coal, followed by India and Japan.

Funny story, China instituted an unofficial boycott of Australian coal last October. This resulted in a major trade conflict between the two countries and global flows of coal underwent major shuffling. Since Australia was out of the picture for China, they imported their coal from Indonesia. India also imported from Indonesia…

A rise in demand, unmatched by a rise in supply led to higher prices. It reached a record high of $122.08 a tonne in the week to October 8. This is 439% higher than the 2020 low of $22.65 per tonne (source: BusinessLine)

Why don’t they just import from Australia? Australian coal ain’t cheap. And it’s high quality coal. In fact, Australian thermal coal at Newcastle Port, the benchmark for the vast Asian market, climbed 106% year-on-year to $166+ per tonne (source: CNBC). Your barbeques might be a little expensive this year!

India is a price-sensitive buyer which explains the low volume of imports. Their imports were merely 2.67 million tonnes in the first week of October, up from 1.46 million tonnes in the week beginning Sept. 13. To give you an idea, India’s imports of thermal coal in the same week last year were a whopping 3.99 million tonnes! Getting back to my original point, this is the reason 2021 is different and why we weren’t able to stock up beforehand. (source: BusinessLine).

Meanwhile, China is dealing with its own blackouts. They are struggling with a severe shortage of electricity, leaving millions of homes and businesses hit by power cuts. This isn’t so uncommon in the country. However, electricity suppliers are dealing with a perfect storm this time (quite literally and metaphorically). The problem is particularly severe in north-eastern China, the industrial hub. Now that is something that could have implications for the rest of the world.

During times of peak consumption in the summer and winter, China’s problem of power outages becomes particularly acute. But this year, a plethora of factors have come together to make the issue especially serious.

China requires a lot of energy to run the country. After all, it’s the world’s most populated country and an industrial hub (think: cement, steel, oil refining, crypto mining etc.). Even though they’re trying to cut down on their carbon emissions, they derive more than 50% of their energy from fossil fuels like coal.

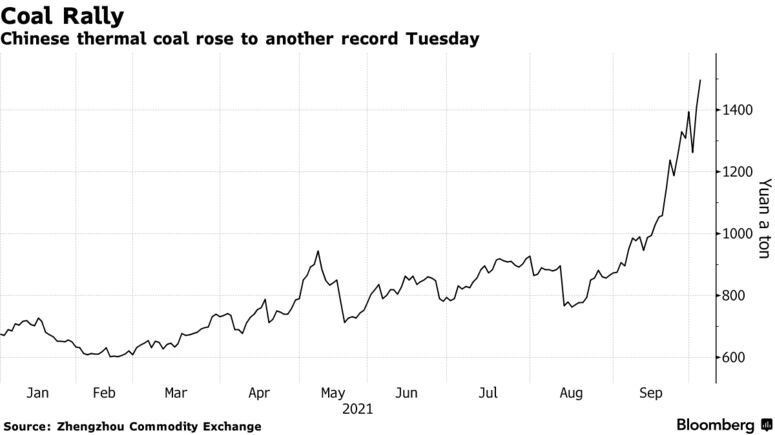

As the world begins to reopen after the pandemic, customers are revenge shopping and the demand for Chinese goods is rising and the factories making them need a lot more power. Hence, the electricity demand has surged. But coal reserves couldn’t keep up with this fast paced rise in demand. Which is why, it’s no surprise that coal’s price has been pushed up. But the government has been strictly controlling electricity prices. This means, the production houses have to bear the brunt of the coal price rise on their own and they cannot share it with the consumers. Coal-fired power plants aren’t happy with this. They are unwilling to operate at a loss, understandably so. Instead, many drastically reduced their output.

On top of all this, heavy rains hit Shanxi, the country’s biggest coal producing province, in recent days. In July this year, record floods struck the mining region of Henan. These further complicated their efforts to increase fuel supplies and ease their energy crisis. Shanxi is central to coal production in China. They are responsible for producing around one third of China’s coal supplies this year. When they were forced to shut dozens of mines due to flooding. Although some sites are slowly resuming operations.

In a desperate attempt by authorities to increase coal supplies, Beijing ordered China’s coal mines to boost output. The problem is becoming critical now a electricity shortage is forcing energy firms to ration power. Manufacturing hubs have been hit particularly hard. It could translate into a 30% slowdown in activity in the most energy-intensive sectors such as steel, chemicals and cement-making (source: Bloomberg).

Domestic production wasn’t producing as much as they generally do, so their coal reserves depleted . They imported 32.9m tonnes of coal in September, 76% more than it did during the same month last year (lucky Indonesia). (source: BBC)

That’s China’s energy crisis in a nutshell. Ensuring coal supply is a priority right now and their carbon-neutral future has taken a back seat, at least for the time being.

While flooding is affecting China’s power generation, water shortage in Europe is affecting the Nordic countries’ power supply.

Europe is shifting to natural gas to reduce their carbon emissions and increase use of cleaner fuels. But there isn’t enough gas to fuel the post-pandemic recovery and refill depleted stocks before winter season, since natural gas is used to heat homes. Countries are trying to outbid one another for supplies as exporters like Russia are importing less and keeping more gas for themselves. This is massively pushing up prices and the crunch is expected to get worse when the temperature drops. The prices have surged by almost 500% in the past year (source: Bloomberg)!

Using coal isn’t an option either since their prices are soaring as well. This is directly affecting manufacturing. Warnings of blackouts and factories being shut can be trouble for the rest of the world. Especially with the holiday season approaching, demand will surge and prices of commodities will rise. You should start buying your holiday decorations and gifts!

This crisis is moving north as Nordic countries, which are heavily dependent on hydro-electricity, are faced with dwindling water reserves, hampering their electricity generation capacity. Norway’s biggest tank’s filling capacity was merely 52.3% for the week starting September 20th, the lowest since 2006. Sweden is relying on a 52-year-old plant that burns oil to keep the lights on. Prices are soaring, and inflation is peaking in a lot of countries. (source: Bloomberg)

Inventories at European storage facilities are at historically low levels for this time of the year. Pipeline flows from Russia and Norway have been limited. Calmer weather has reduced output from wind turbines in Europe. Manufacturing plants have been hit by power shortages in China, pushing up prices for steel and aluminum. Power plants have to reduce their electricity generation due to lack of coal in India, impacting the industrial sector. Coal and natural gas are trading at record-high prices. These shortages are causing inflationary pressure and impacting economic recovery from the pandemic. The energy crisis is a global issue now. This winter will act as a reminder of our dependence on fossil fuels…

Leave a comment