Netflix released their third quarter earnings and it wasn’t great. They added only 8.3 million subscribers in the last quarter. The company fell short of its own prediction of 8.5 million new subscribers in the quarter. In 2021, they added a total of 18 million subscribers, which is less than half of 37 million in 2020. As expected by many, their subscriber growth is slowing down. The shareholders responded to their earnings quickly and mercilessly resulting in their stock price plummeting by over 20%. (source: Netflix)

This comes in the backdrop of a stellar year for Netflix. They released a record-breaking show- Squid Game. Originally a Korean show, it was viewed by viewers around the world and gained global recognition. They had the two biggest film releases- Red Notice and Don’t Look Up. They received Emmy and Oscar nominations and hosted 7 out of the 10 most watched TV shows of 2021. (source: Finshots)

Netflix also said that they expect to have 224.3 million subscribers at the first quarter of 2022, which would be a gain of fewer than 2.5 million new customers. This dampened the investors’ spirit. (source: Deadline)

And that’s why their stocks fell by over 20%. Netflix and stress?

In their letter to shareholders, Netflix tried to identify a reason for the fall in share prices. They noticed a “healthy retention with churn down, healthy viewing and engagement with viewing up and acquisition just growing, but a bit slower than pre-COVID. Just hasn’t fully recovered.”

Netflix is also facing increased competition from it’s counterparts like PrimeVideo, Disney+/Hotstar, Hulu, HBO Max. etc. There have been many new streaming platforms that emerged in the past 2 years. Netflix is spending billions of dollars to generate content and keep their subscribers interest, while also creating FOMO among non-subscribers.

They couldn’t pinpoint the slow growth on anything in particular. They think it’s just a bit of “COVID overhang”, that they’re still not out of, 2 years after the global pandemic began. Also, some parts of the world like Latin America (one of Netflix’s key growth markets), are still facing macroeconomic strain. With money hard to come by, not spending on OTT platforms would be a way to cut costs.

International markets are significant for Netflix since 60% of their revenues now come from non-US markets. This means they received their revenues in currencies that are not denominated in dollars. So, when the value of US dollar appreciates against a foreign currency, they get to take home fewer dollars (since 1 dollar costs more rupees if the value of dollar appreciates). Unfortunately for Netflix, US dollar performed really well this year and strengthened in comparison to most foreign currencies. Their estimates show that this could cost them as much as $1 billion in lost revenue in 2022. (source: BBC)

In an attempt to make up for some of the lost revenue, they increased subscription prices US and Canada. However, in India, they had to slash prices. That’s right.

When Netflix entered the Indian market, they had big dreams and grand ambitions. So much so, that in 2018 Reed Hastings, Netflix’s CEO, told a global business summit in Delhi that the company’s next 100 million subscribers would be coming from India because of expanding and cheap internet. Three years later, he doesn’t sound so sure. On an investor call, he had good news and bad news. The good news being that in every single other major market, they’ve got the flywheel spinning. The bad news is that they have not been as successful in India.

India is an important market because of the huge population. If they can tap into that, they’ve got themselves lotsss of subscribers. They have been trying to win over India since 2018. They talked about investing in content back then and introduced the mobile plan, something no other country had. Now, in 2022, they’re still talking about the same things.

Their investment in content in India was bigger than ever. They introduced another mobile-only plan. They slashed prices even further.

Clearly something isn’t working out for them.

India’s $2 billion streaming industry is fuelled by around 100 million subscriptions. While Netflix doesn’t disclose how many subscribers it exactly has in India, it is estimated to be around 5.5 million, compared to approximately 22 million subs on Amazon Prime Video and around 46 million subs on Hotstar. (source: BBC)

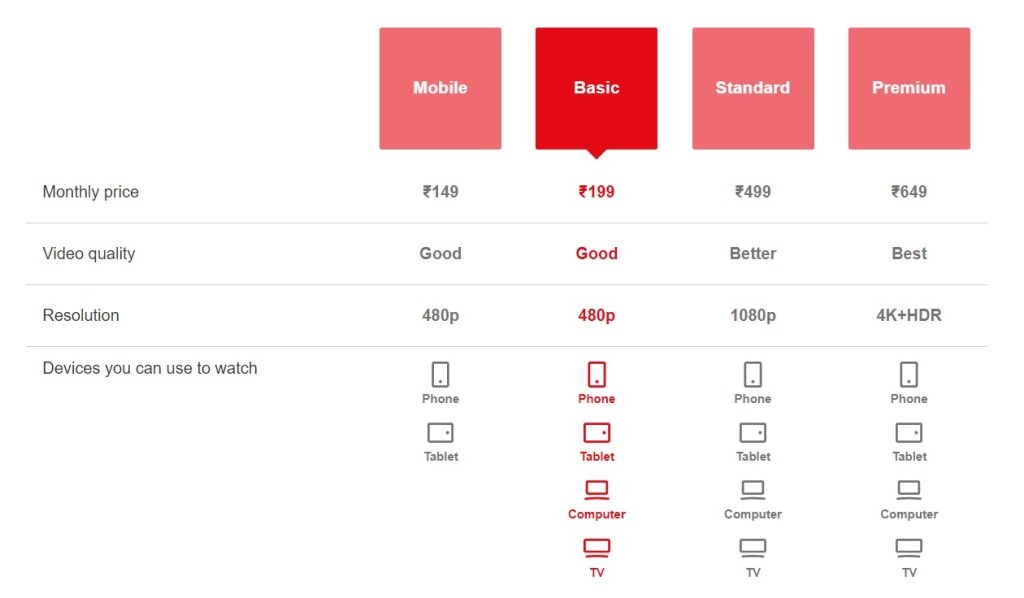

Let’s look at the pricing. The entertainment market in India is large. More than 200 million households own TV sets, and pay TV is as cheap as $4 a month. When we look at streaming platforms, both Amazon and Hotstar are cheaper than Netflix. In the beginning of 2021, Netflix cost anywhere between ₹199- ₹799 a month (~$2.7-$11). Whereas, Prime ranged between ₹80- ₹129 a month (~$1-$1.7). Hotstar was more expensive than Prime, but still less expensive than Netflix.

High price seems like a reason for few subscribers in India. But when Netflix reduced their prices to historic lows in India, Hotstar followed by Prime increased their prices for the first time in years. Their prices are still lower than than of Netflix but it’s still a risky move.

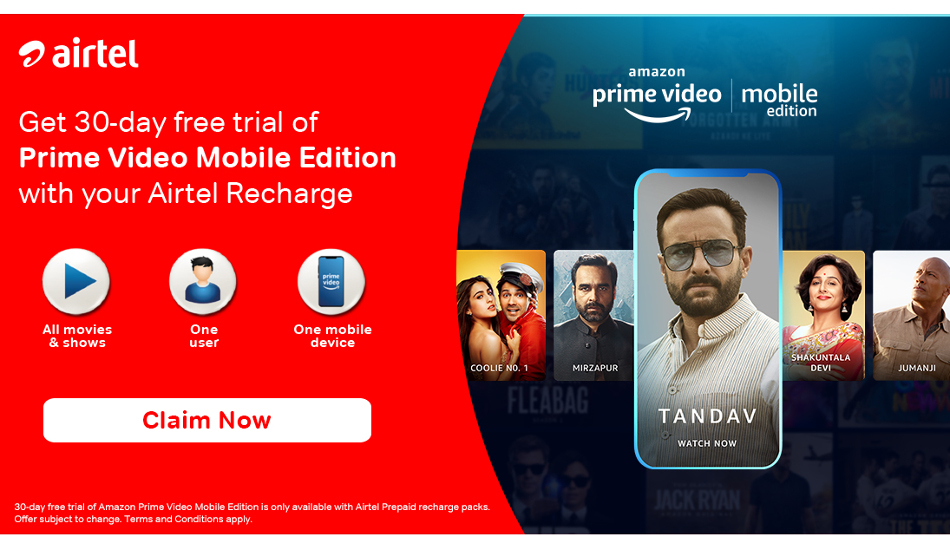

Nearly 78% of all streaming revenue in India was taken by just Hotstar and Netflix. According to an analyst, Netflix clearly earns more revenue per user per month than Disney+/Hotstar (source: Nasdaq). That’s because Prime and Hotstar bundled their subscriptions with telecom service plans with players like Jio and Airtel. Basically, these companies approach customers and convince them to recharge and they’ll throw in a free OTT subscription. In Oct’20, there was an estimate that out of Prime’s 10 million subscribers, just 40% of them actually pay for their subscription. Rest of them have access because of some bundle plan (source: Inc42).

So pricing is probably not the reason. Well, not the sole reason at least. It’s distribution. Amazon and Hotstar Disney+ have been able to crack it but Netflix hasn’t.

Let’s talk about content. Netflix has faced some criticism in regards to their content strategy in India. People say they don’t have a lot of relatable content, it’s not local enough. However, Prime’s strategy isn’t that different or extraordinary that it attracts so many viewers. Prime Video has an added advantage in this sense because you’re not just paying for a Prime Video subscription, you’re also paying for Amazon Music, Amazon’s free delivery and faster delivery. Just 30% of Amazon Prime’s subscribers use it to watch videos according to a report by RedSeer. Rest of them are more interested in buying stuff at exclusive prices and the free delivery. So what consists of content is different from Amazon than it is to Netflix.

In India, entertainment means sports, especially cricket, films and news. That brings us to Hotstar. Their main selling point is IPL. Hotstar makes a bulk of it’s revenues in the 2 months when IPL is being played. The company expects to make nearly ₹750 crore from this season, which is about the same amount it earned in 2020, its first Covid-affected season. It’s also 3x of what the industry estimated it would earn. They don’t just get their revenue from subscriptions, they also get it from advertisements. (source: The Ken)

Live sports is attractive to an Indian audience. Sony Liv has the streaming rights for India’s matches and that has definitely helped them gain popularity. Amazon also jumped into this in the beginning of 2022, when they streamed New Zealand’s series with Bangladesh. They bought exclusive rights to stream New Zealand’s international cricket matches.

Netflix will need to do something of this sort to penetrate into the Indian market and give the audience something they don’t want to miss. Every market has a different audience and they have to cater to each of them individually, only then will they be able to keep up their subscriber growth rate.

Disney+ Hotstar is relatively new. Even though their subscriber growth rate decelerated, it’s still not as low as Netflix. It’s still easy to get the first few million, getting the next few is the tough part. And that’s where Netflix is at currently.

Leave a comment