Inflation captivated the world’s attention in the second half of 2021. With the new year, came news of inflation rates. Seems like we’ll be spending the first few months of 2022 fighting the inflation battle.

U.S. consumer prices soared last year by the most in nearly four decades. The Labor Department released data in the beginning of this month that indicated the consumer price index climbed 7% in 2021, the largest 12 month gain since 1982! (source: WSJ)

Core inflation, which is the change in costs of goods and services excluding the food and energy sectors (because of their volatility), is accelerating rapidly. The measure jumped 5.5% as compared to the previous year- the biggest advance since 1991. It was led by higher prices for shelter and used vehicles.

When this data was released, it created panic among people since they expected the Fed to raise interest rates, beginning March. The stock market was turbulent because of market expectations for Fed tightening. U.S. markets fell in reaction to the report by the Labor Department.

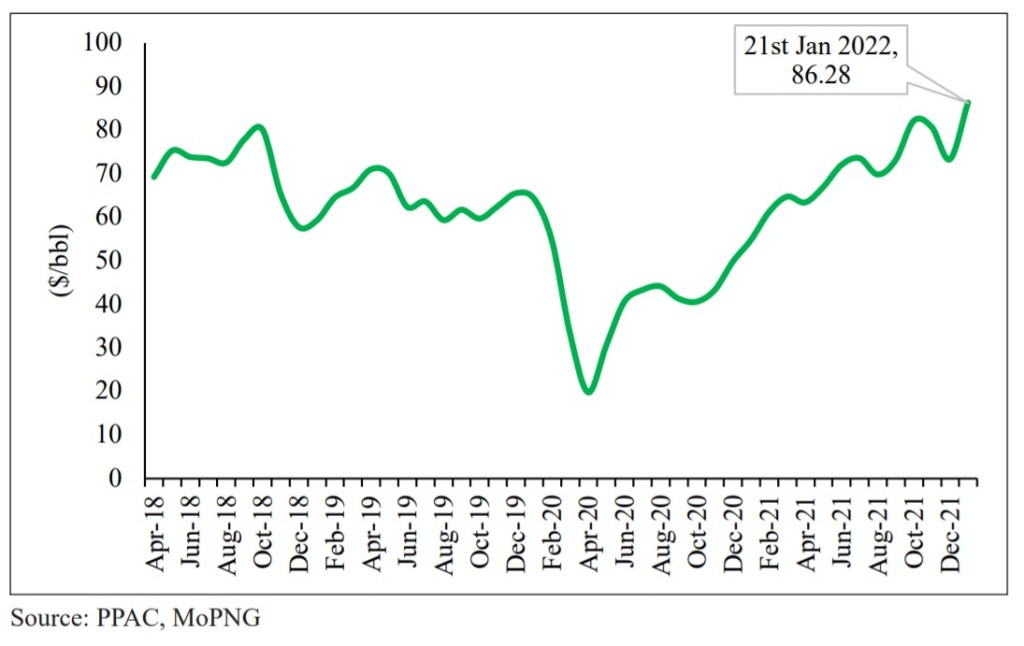

In 2021, economic activity revived with the ease in Covid related restrictions. Pandemic related stimulus spending, mostly in the form of discretionary handouts to households in major economies, along with a pent up demand fueling customer spending, pushed inflation up in advanced and emerging economies. Surge in energy, food, non-food items, supply constraints, disruption of supply chains, rising freight prices across the globe etc. fueled high prices everywhere in 2021. Furthermore, we witnessed a rise in crude oil prices as there was an increased demand from recovering economies and supply cuts by the Organization of Petroleum Exporting Countries and its allies (OPEC+).

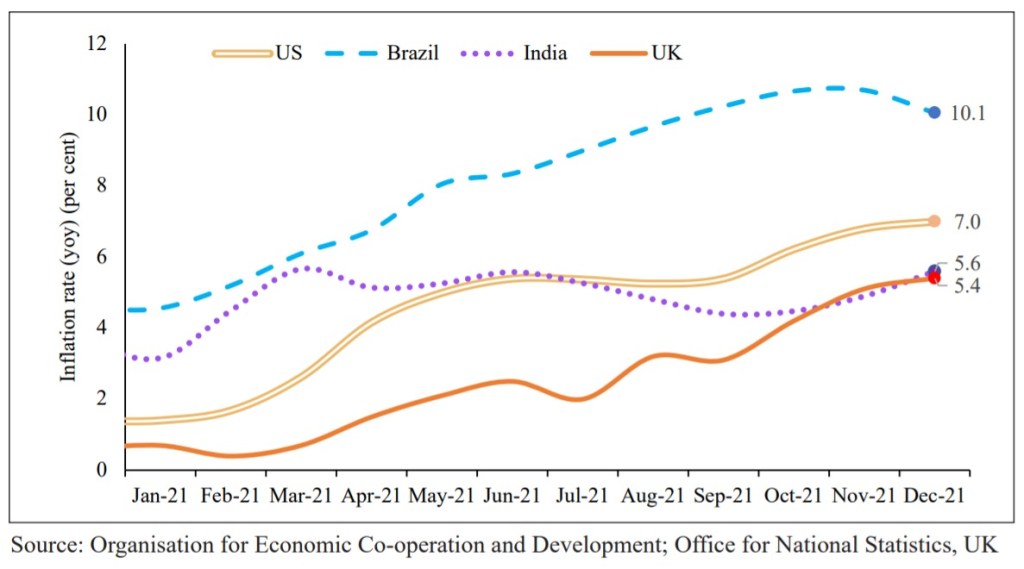

This means that inflation isn’t just a problem that advanced economies are dealing with, it’s a problem countries around the world are currently facing. In UK, inflation hit a nearly 30 years high of 5.4% in December 2021 mainly on account of rising food prices. Among emerging markets, Brazil witnessed high and rising inflation during 2021, which touched 10.1% in December’21. Argentina has witnessed inflation rates above 50% during the last six months. Turkey’s inflation hit a record high but that’s because of their currency crisis. (source: Economic Survey 2021-22)

The Annual Economic Survey for 2021-22 warns that India needs to be wary of imported inflation, especially from elevated global energy prices. The Economic Survey, which is presented in the parliament, the day before the budget, gave an insight into some of the inflation trends in India.

Consumer Price Index (CPI), which is usually used as a measure of retail inflation, was 5.6% in December 2021. That’s not an alarming figure since it’s under the targeted tolerance band. The Wholesale Price inflation, however, has been running in double digits. A part of this rise in wholesale inflation can be attributed to the low base in the previous year. It’s also because of rising input costs and global commodity prices.

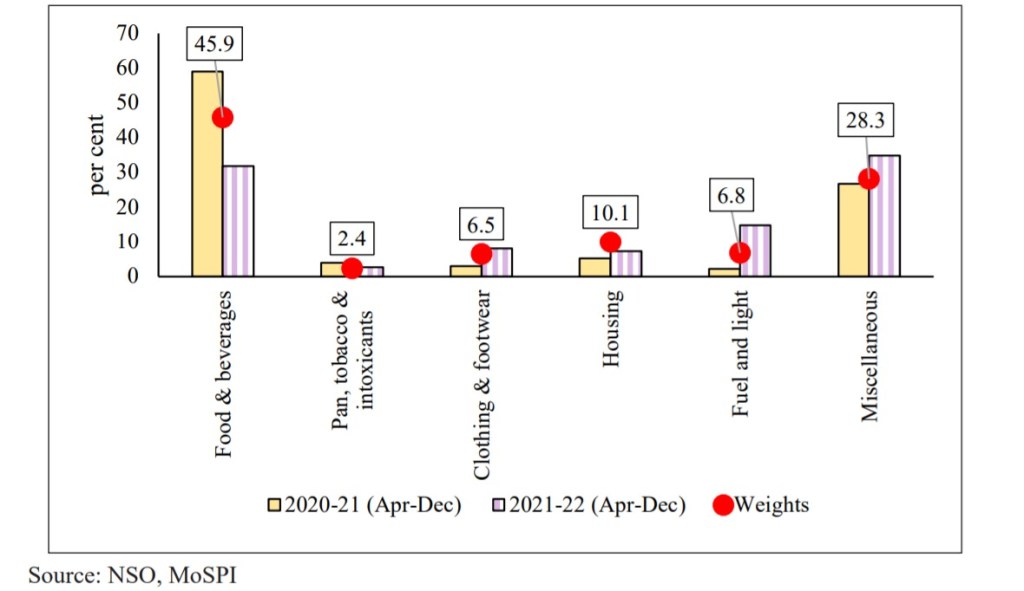

Let’s talk about retail inflation first. This is the kind of inflation that directly affects the consumers. It measures the rate of increase of price of certain goods or commodities compared to a base price. India’s retail inflation rates fell from 6.6% in 2020-21 to 5.2% in 2021-22 during April-December. This was largely driven by easing of food inflation. Food inflation, as measured by Consumer Food Price Index, averaged at a low 2.9% in 2021-22 (April-December), as against 9.1% in the corresponding period last year. While inflation steadily declined between July and September 2021, it increased to about 4% in December. (source: Economic Survey)

The major drivers for retail inflation have been the miscellaneous and “fuel and light” group. The miscellaneous group includes transport and communication, health etc.

In April 2020, when the pandemic had just begun, the price of crude oil dipped massively in response to a subdued global demand because of Covid restrictions. However, this was followed by an upward trend in the price of crude oil on account of unprecedented cuts in oil supply by OPEC and other oil producing countries. The upward trend continued in 2021 as the demand picked up with an ease in Covid restrictions in most part of the worlds. The supply hasn’t been able to keep up with the pace of economic recovery due to the production cuts made last year. The heightened prices of crude oil led to a rise in prices for “fuel and light” and “transport.”

The prices fell since the second half of October following rise in Covid cases in Europe and possibility of release of crude oil from strategic reserves by the USA and other countries. However, in January, crude oil prices witnessed an uptick amid concerns about rising geopolitical uncertainties in Easter Europe and the Middle East.

‘Clothing and footwear” inflation also saw a rising trend during the current financial year possibly indicating higher input costs and revival of consumer demand- think: revenge spending.

It was a rocky year for ‘Food and Beverages’ inflation. The overall retail food inflation remained above 8% from Novemeber’19 to November’20, but declined to 2.9% in 2021-22 (April-Dec). Inflation in cereals and products was negative during April to Sept’21 and remained low in Oct-Dec’21 which implies there was a sufficient supply of cereals.

‘Oils and Fats’ contributed around 60% to food and beverage inflation. The inflation has risen sharply since mid-2019 and remained in double digits since April 2020. Its inflation has been 30.9% for the period April-December’21 and stood at 24.3% in Dec’21. This has been mainly due to our high dependence on imports for edible oils. As we have talked about earlier, the price of edible oils like Palm oil, Sunflower oil etc. have been rising because of various reasons like disruption in crop production, cut down in supply from foreign countries etc. (The story: We need Oil, the Edible kind).

Protein based items like ‘meat and fish’ were one of the factors fueling food inflation. Healthy eating became more expensive! Supply chain disruptions and high poultry feed prices (because of high prices of soybean meal), elevated inflation for meat. Although, it did decrease to 8% this year as compared to a whopping 15.4% in 2020-21. It started declining from Sept’21 and was at its lowest in December’21- 4.6%. Eggs, however, showed a steady decline in FY22 and their inflation even remained negative for the months of October and November. Much to the relief of households, pulses, a staple food item in many Indian houses, has been on the fall since July’21. (source: Economic Survey)

You must have heard about the high prices of tomatoes and onion. I know I heard my parents complain about it.

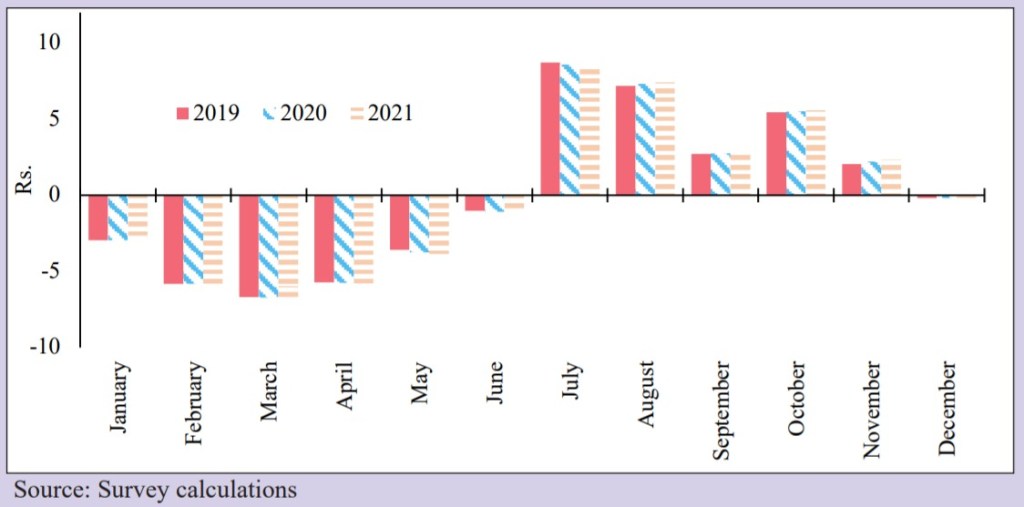

But why were tomatoes so expensive? Seasons!

The seasonal components tend to put an upwards pressure on prices of tomato during the period from July to November, every year. On the other hand, seasonal factors put the largest downward pressure on prices in March. This happens because of the pattern of production. 70% of the tomato grown by farmers is sown in October-February and is harvested during December-June ie. they’re mainly grown in the rabi season. Kharif production, during July-November, usually contributes less than 30% of the total production of tomatoes in a year. Because of this, there is always a rise in prices of tomatoes around this time of the year. However, the price rise is not shocking and is approximately ₹15 higher in July as compared to March.

This time, another factor was also at play- unseasonal rains. Punjab, Haryana, UP and Himachal Pradesh faced heavy rains, leading to crop damage. These northern states are the major crop producing states of India. Delayed arrival from these states was followed by heavy rains in the southern states like Tamil Nadu, Karnataka, Telangana and Andhra Pradesh. Thus, the supply was further disrupted causing an imbalance in the supply and demand.

Seasonal components coupled with heavy and unusual rainfall in January has also affected the onion crop. Their price is above the normal rate, and is expected to steeply rise in February.

The consumers have felt the impact of inflation and noticed a significant rise in prices especially for food items and oil. FMCG companies noticed lower demand in rural areas due to inflation. Appropriate measures have to be taken by the government in order to control inflation.

The economic survey has said the economy is well placed to take on challenged in the coming year. They projected India’s GDP growth rate for FY23 at 8.5%, which is lower than IMF’s estimate of 9%. But it still means India’s economy will be the fastest growing among major economies.

Leave a comment