In one of the biggest crashes in crypto history, LUNA collapsed, wiping away millions of dollars from the crypto economy. But how did we get here from LUNA’s high??

To understand why exactly LUNA crashed, we need to understand certain terms and the history of LUNA.

TerraUSD and LUNA are like ketchup and fries, They’re complementary goods.

Terra USD (also known as UST) and LUNA are two sister coins in the same network. Terra is a blockchain network, similar to Ethereum and Blockchain, that produces Luna tokens. It was created in 2018 by Do Kwon and Daniel Shin of Terraform Labs in 2018.

Terraform Labs created the UST coin to be an algorithmic stable coin on the Terra Network. Usually, stable coins are fiat-backed to maintain their stability (for ex- USDC or Tether). But the makers at Terraform labs decided to get experimental… They decided that UST would not be backed by any real assets. Instead, it was to be backed by its sister coin Luna.

Usually a stable coin is pegged to a more stable currency like the US dollar. They are used to hedge volatility in the crypto space. For example, let’s assume that Ether’s price is $10,000. You could exchange one Ether for 10,000 USDC tokens. When investors expect a hit in the market, they put their money into stable coins for safe keeping and to protect their assets.

But Luna wasn’t backed by an actual currency. Essentially, Luna tokens act as collateral for UST and are responsible for maintaining the stability of UST. The idea was to maintain stability through a 1:1 mint and burn ratio with Luna. A user must burn an equal amount of Luna to mint the equivalent amount of UST. When Luna’s price was $100, you could trade one token for 100 UST. This protocol was designed to ensure long-term growth for the currency.

They thought they could use clever mechanisms along with billions in Bitcoin reserves to maintain the peg of UST without USD. Terraform Labs founder and CEO, Do Kwon, created the Luna Foundation Guard (LFG), a consortium whose job is to maintain the peg. The LFG had about $2.3 billion in bitcoin reserves, with plans to expand it to $10 billion worth of bitcoin and other crypto assets (source: yourstory). If the price of UST dipped below $1, reserves would be sold and UST bought with the proceeds. If the price rose above $1, creators would sell UST until it goes back to $1. Kind of like a fixed exchange system.

On paper, this market system is highly efficient. It’s more capital efficient (due to zero reliance on demand for debt) but let’s see how it played out in real life.

Luna was Terra’s blockchain native token, and it worked much like ether does on the Ethereum Network. Luna performed four different tasks within the Terra Network:

- A method for transaction fees in the Terra network

- A mechanism for maintaining Terra’s stable coin peg

- Staking in Terra’s delegated proof of stake (DPoS) to validate network transactions

- To participate in the platform’s governance by adding to and voting on proposals when it comes to changes in the Terra network

How was Luna doing before the crash? Extremely well. A Luna coin was going for $116 in April before dropping. Luna’s valuation was beyond the moon, to the sun. But it flew too high too fast, just like Icarus.

The coin went from being worth less than $1 in early 2021 to creating many crypto millionaires within a year. Because of this Do Kwon earnt a cult hero sort of status among some retail crypto investors. People from all over the world shared stories about how they became so rich because of Luna. It skyrocketed about 135% in less than two months, until its peak in April 2022.

How did Luna become so popular? Hearing other people’s stories about become millionaires by investing in this currency was surely a contributing factor. But the biggest incentive was you could stake your UST holdings on the Anchor lending platform for a 20% annual yield. Anchor Protocol is a De-Fi protocol that allows users to enjoy a stable coin based lending financial system. It serves as a money market between lenders and borrowers of stable coins. Lenders deposit their stable coins on the platform. They use it to make collateralized loans and the lender earns interest. Borrowers can borrow them by providing stakeable assets as collateral.

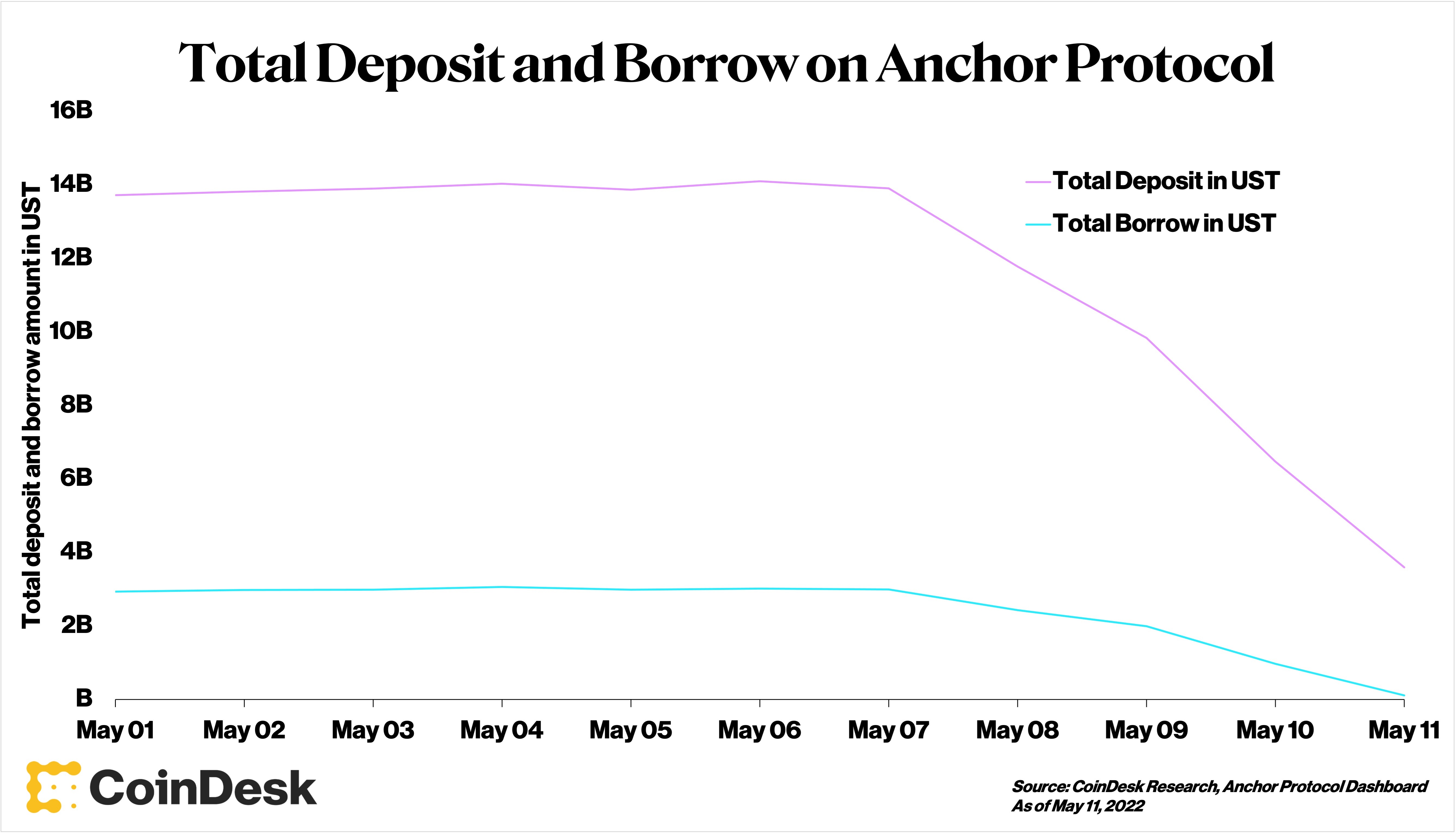

Anchor was promising 20% returns in a year through loaning, rewards, etc. This platform also gained popularity because of this deal. It undoubtedly popularised the currency but was too good to be true for any instrument in the world. People in the industry were skeptical as to where this money would come from to pay these rates. Some considered this an obvious Ponzi scheme. Many analysts felt that this rate was unsustainable in the long term. At one point, a whopping 72% of UST was deposited in Anchor because it was the primary driver of demand for Terra (source: Forbes). That’s $14 billion of UST out of a total circulating supply of $18 billion (source: Coindesk). With so much money deposited in anchor, it was evident that the investors were doing it for the dollar bills 🤑.

Now that we have the backstory, let’s come to the point. What actually happened?

We know UST is an algorithmic stable coin. For UST to retain its peg, one UST could be changed for $1 worth of Luna at any time. This was the key to UST retaining its peg. So, if the price of Terra slipped even by 1 cent per token, traders could make money by buying a huge amount of UST and exchanging it for Luna.

It was not pegged to USD through any physical assets, but the stated objective was to peg it to 1 USD through advance algorithms and trading. But when it lost its peg to the dollar, both Luna and Terra crashed.

Anchor was responsible for Luna’s rise, but it was also its Achilles heels. One of the earliest sings that things were going wrong for UST was when the deposits on Anchor started dropping. Hundreds of millions of UST were quickly liquidated. The deposits dropped sharply, from $14 billion to $3 billion (source: euronews)! The fact that UST’s main hub was losing so much money indicated a severe decline in confidence in the Terra protocol as a whole.

The exact reason as to why over $2 billion worth of UST was unstaked is an ongoing debate. Was it because of rising interest rates? Was it a malicious attack on Terra blockchain? If it was an attack, was coordinated by rich whales or the work of a lone wolf? A lot of questions left unanswered for sure, but UST’s fall was inevitable.

The massive sell-offs reduced the price of UST from $1 to $0.91. That’s why, traders started exchanging 90 cents worth of UST for $1 of Luna. This was the start of a vicious circle. After offloading a significant amount of UST, the stablecoin began to depeg. People panicked and sold more UST. This led to the minting of more Luna and an increase in the circulating supply of Luna. Over the next few days, Terra and Luna were in a race to the bottom.

Following this crash, crypto exchanges started to delist Luna and Terra pairings. Luna was abandoned and it became worthless.

What did the Luna Foundation Guard (LFG) do? They tried to control the situation by deploying over $2 billion from their Bitcoin reserves. LFG also “loaned” billions of dollars worth of reserve assets to professional market makers, draining their blockchain wallets almost entirely in the process. But their efforts were in vain.

Luna fell below 30 cents for a brief period of time, leading to questions about whether it will ever regain its stability (source: coindesk).

How did this impact the market? The crypto market was already highly volatile and was experiencing some difficulties. That’s why the Luna meltdown hit like a truck and impacted the entire market. It is estimated that the crash ended up tanking the price of Bitcoin and causing an estimated loss of $300 billion in value across the entire cryptocurrency ecosystem (source: Forbes).

Crypto companies like Voyager and Celsius declared bankruptcy and Three Arrows Capital (3AC) was forced into liquidation.

Many people lost their life savings and suffered financial hardships due to the crash. Only those people who exited right before the crash were able to profit from the situation. One example is the hedge fund Panera Capital. They saw a 100x return on an initial investment of $1.7 million. The company liquidated its Luna position prior to the collapse for a whopping return of $171 million (source: Forbes).

Hold up, it gets more interesting!

Do Kown shared a recovery plan for Luna and things looked promising for a brief period of time in May, after the original crash? Eventually, the coin plummeted and was abandoned.

On September 15th, the South Korean court announced that they had released an arrest warrant for Do Kwon! The warrant came almost 4 moths post-crash. He’s accused, along with five other people, for violating local market laws.

The prosecutors sought to freeze a total of 3,313 bitcoins (worth about $67 million) linked to Kwon (source: Bloomberg). However, he said that this was “misinformation” and that “there is no cashout as alleged.”

No one knows where he currently is… The government thinks he’s on the run but he denied that via a Twitter thread:

As of now, the South Korean Ministry of Foreign Affairs has ordered Kwon to return his local passport within 14 days. If he doesn’t do so, he will risk losing the passport and/or face re-application rejections. They arrested a person from Terraform Labs by the name Yu, the head of general business operations, Following which, they dismissed the arrest warrant for another employee from the firm. However, they’re still on the hunt for Kwon.

Whether Do Kwon was genuinely trying something new or if he was just hyping up his currency and network falls in a grey area. The time was probably not right for this. If, in the future, someone was to create another algorithmic stable coin, they would have a starting point and certain do’s and don’ts to help them out. Maybe this is the future?

Moral of the story: If something is too good to be true, it probably is 🤷♀️

One thought on “Decrypting the Luna crash”