From being mentioned on Forbes’ annual ranking of America’s Best Banks for the 5th straight year to their assets getting completely seized, Silicon Valley Bank (SVB) has definitely had three crazy stressful days!

What exactly is the flow of events that led to the second largest bank failure in the history of US?

Before talking about the events of the past 3 days, we need some background.

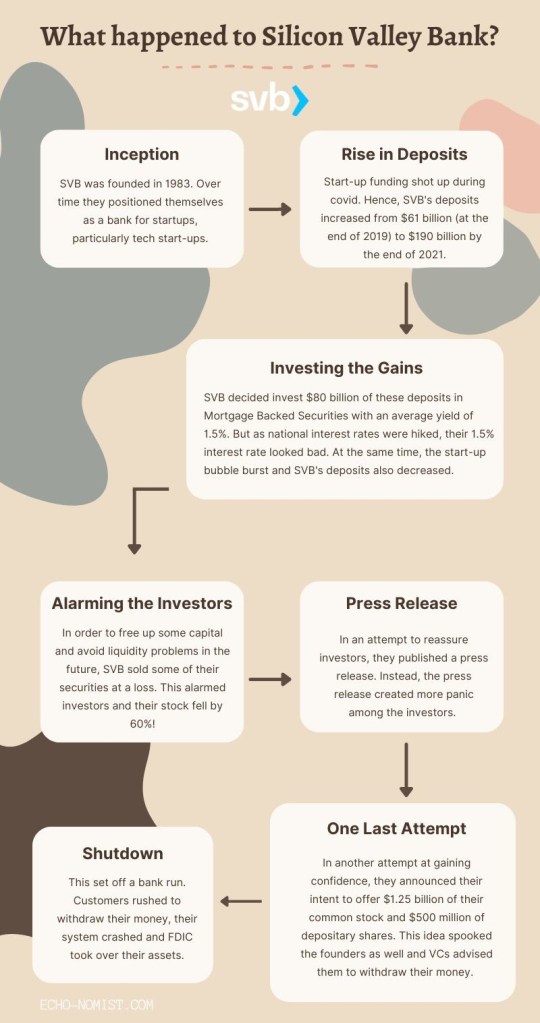

Founded 50 years ago, over time SVB became the go-to bank for startups. They positioned themselves at a primary position in the startup ecosystem, particularly for tech startups.

The pandemic had created an environment wherein startups were thriving. It was a golden time for them to raise money. Venture capitalists were pouring in money and startups were at the receiving end of it. Startups had a crazy amount of cash in hand. Since they weren’t using it immediately they decided to deposit it in the bank. The choice of bank for a lot of startups (especially tech startups) was SVB. Subsequently, the value of their deposits jumped from $61 billion (at the end of 2019) to $190 billion by the end of 2021 (source: Morning Brew).

Now SVB was faced with a new problem. What to do with all this insane amount of cash? Instead of letting it lie around, they decided to put the money to work. As a result, they bought $80 billion in Mortgage Backed Securities (MBS) with an average yield of 1.5%. MBS’ aren’t invested for short term gains and typically have stated maturities of 5, 15 or 30 years. At the time of investing, an interest rate of 1.5% didn’t look half bad since interest rates were at historic lows. However, not long after, the Fed started increasing interest rates. Every subsequent hike in interest rates painted an increasingly worse picture of the $80 billion invested in MBS.

While this was going on, startups also started raising less money. Hence, SVB’s deposits also started to fall. The startup bubble had been popped. The absurdly high valuations given to startups came back down to earth, thus reducing the bank’s inflows. Nothing was falling in place for SVB.

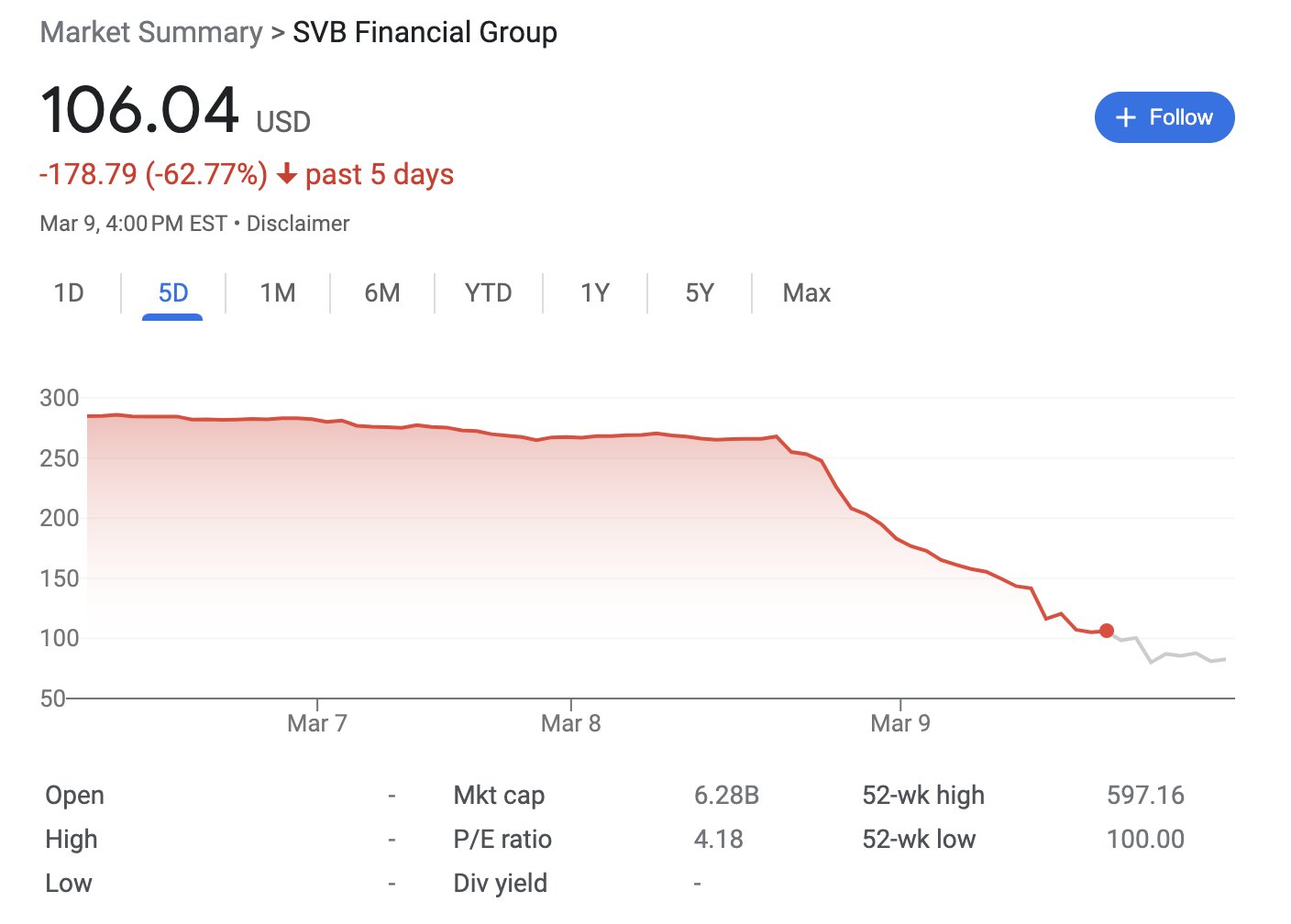

Skip to March 8th, Silicon Valley Bank was sort of in a precarious position. Their deposits were falling and they had $80 billion invested with low returns but people were still withdrawing money. To be on the safe side and to give themselves a little breathing room, SVB decided to sell some of its securities. These securities were sold at a loss because they were withdrawn prematurely. The idea was just to free up some capital to avoid a liquidity problem in the future. The market definitely did NOT react as expected. Investors panicked and reacted by selling its shares. SVB’s stock fell by more than 60%! It turned out to be a huge mistake on their part as investors assumed they had a liquidity issue when in reality they did not.

This called for some damage control. So they published a press release. Once again, investors reacted to it in a manner completely opposite to what they expected. It managed to make investors more nervous, which led the stock to plummet further.

All of their ideas at this stage had failed… miserably. Naturally, they decided to come up with another idea. Third time’s the charm? This time they proposed a sale. They announced their intent to offer $1.25 billion of their common stock and $500 million of depositary shares (source: Nasdaq).

The investors were nervous as it was, but this idea effectively spooked founders as well. Where founders are, VCs follow. They advised founders to get their money out of SVB. Clearly, third time wasn’t the charm either.

Founders getting spooked just added fuel to the fire. It was just what they needed to set off a bank run. Customers rushed to withdraw money, their system broke down and FDIC took over their assets.

That’s the story of how it happened.

Here’s an explainer to sum it up:

What will the startups, who have millions of dollars deposited, do now?

FDIC will return upto $250,000 to each customer, but only after SVB’s remaining assets are sold to see if they can get any more money back.

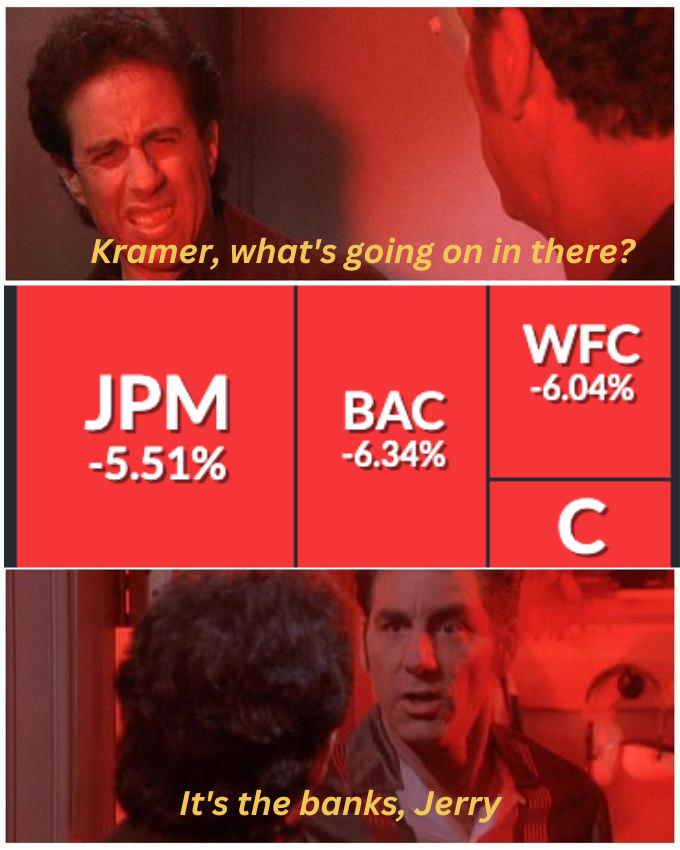

Aftershocks to the banking sector

The broader bank sector is being slammed on the stock market. Shares of JPMorgan Chase, Bank of America and Citigroup among others have fallen more than 5%. The tremors of the SVB earthquake are definitely be felt across the banking sector, but experts aren’t very pessimistic about the aftershocks. The finances of major banks are in much better shape than they were in 2008, which is instilling some confidence among the public.

Way forward?

When Yes Bank collapsed in India, the RBI (Reserve Bank of India) put it under moratorium and ultimately presided over a restructuring that involved infusion of equity by multiple large banks like ICICI Bank, Axis Bank, Kotak Bank and HDFC Bank led by State Bank of India. Timely intervention and swift decisive action by RBI saved the bank, avoiding a huge systemic shock. The bank is fully functional now and none of the customers lost money. Could FDIC follow something similar to save SVB??

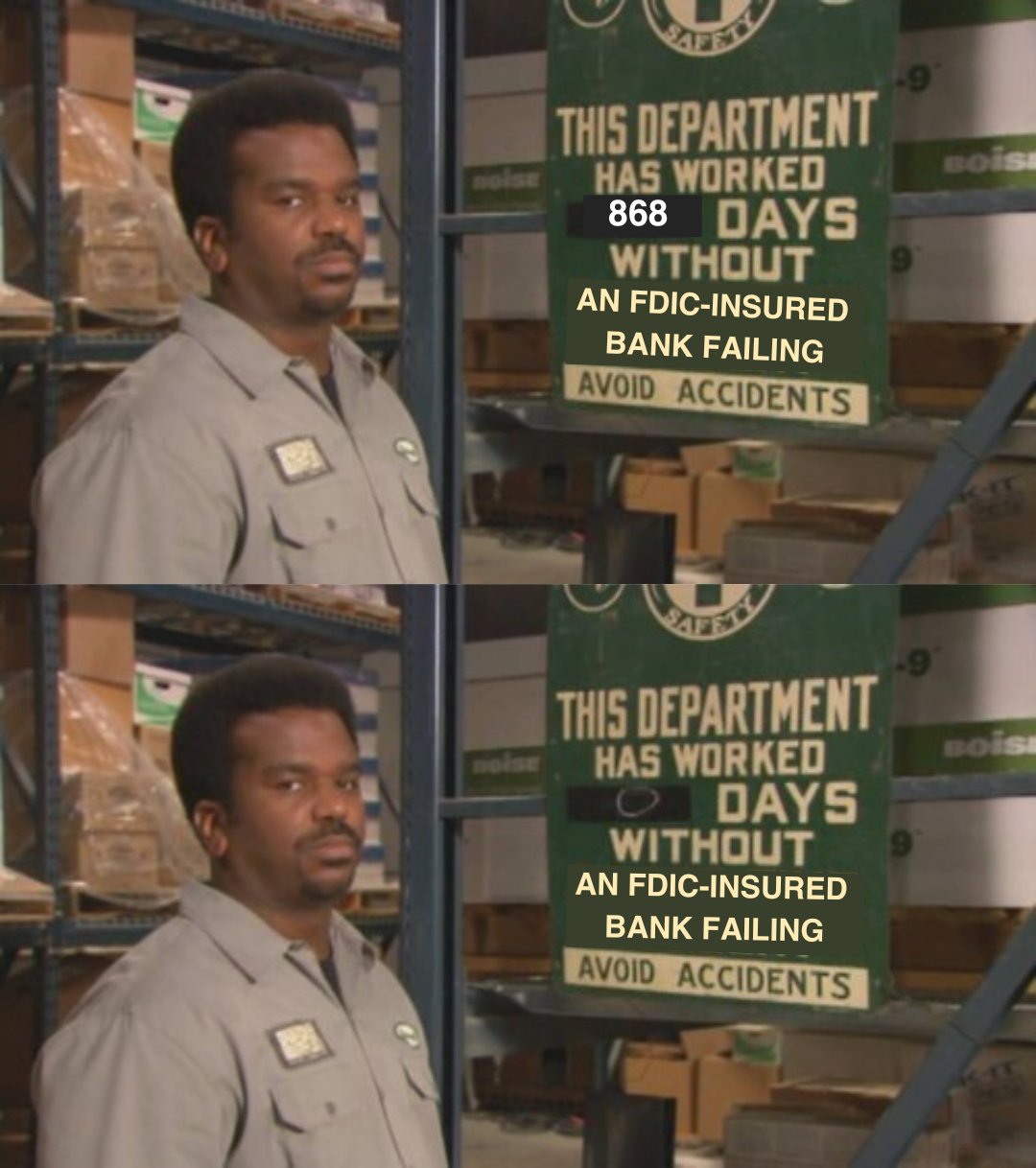

For all the Office fans out there:

UPDATE

In another turn of events, US Fed takes over another bank. This time, it’s Signature Bank, one of the two significant banks for the crypto industry. They had $88.59 billion in deposits as of December 31, 2022!

In a joint statement released by Treasury, Federal Reserve and FDIC, they announced that all depositers in the failed Silicon Valley Bank will have access to all of their funds starting Monday, March 13th. They also announced a “similar systematic risk exception for Signature Bank… All depositors of this institution will be made whole.” You can read the press release here.

Providing depositors full access to their funds will help in instilling some confidence back in the banking system. This is extremely important since the bank business is based on trust.

Leave a comment