Adam Neumann had his Michael Scott moment when his startup, WeWork, declared bankruptcy.

Last week, WeWork filed for Chapter 11 bankruptcy. This is basically a form of bankruptcy that allows a company to stay in business and restructure it’s affairs, debts and assets. But how did they get here?

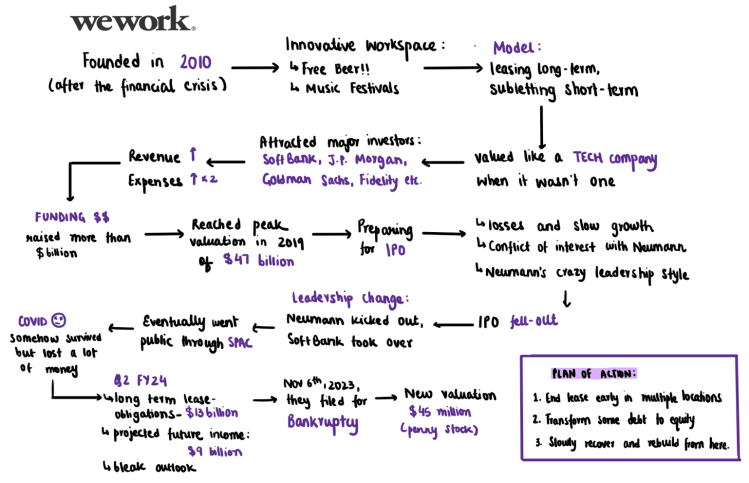

WeWork was founded in 2010 by Miguel McKelvey and Adam Neumann after the financial crisis. The company became synonymous with the extravagant and lively style inspired by their CEO, Neumann. Frustrated with the traditional office model, they set out to create something different, something that went beyond the mundane nine-to-five routine. They recognized a growing need for flexible and collaborative workspaces. They believed that traditional office setups were becoming outdated, especially with the rise of freelancers, startups, and remote workers seeking more dynamic and community-oriented environments.

Their brainchild, WeWork, wasn’t just an office space; it was a community that hosted music festivals and where you were served free beer while working. The air was charged with innovation, collaboration, and the unmistakable buzz of possibility.

While coming up with the business idea for WeWork, they moved away from the traditional real estate model by securing long leases on expansive properties and subletting the space to smaller businesses on more flexible, short-term agreements.

Their model became really popular especially among the younger generation. They expanded within the US and eventually around the globe. The founders positioned WeWork as a tech company rather than a real estate provider, emphasizing the platform’s potential for innovation and disruption in the workplace sector. They raked in funding from various major investors from venture capital firms and banks such as Goldman Sachs, JPMorgan, SoftBank, Fidelity etc. and ended up raising $10 billion.

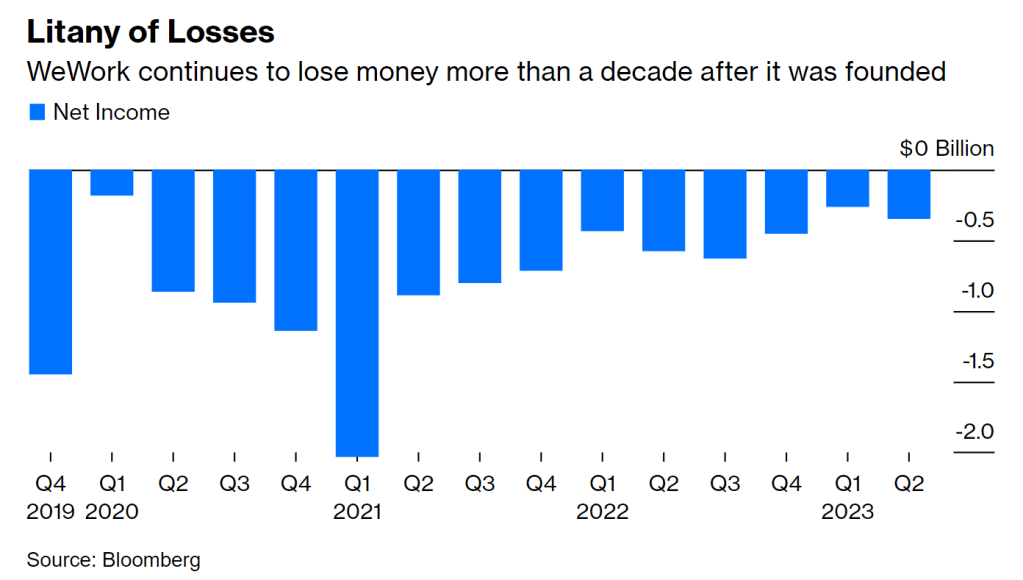

WeWork hit its peak valuation of $47 billion during 2019 and began working towards an Initial Public Offering (IPO). While gearing up for an IPO, they released their numbers to the public and that’s when people realised… something’s off. Due to their model, their revenue was growing but at a slower pace when compared to its expenses. Even the billions of dollars they collected through funding didn’t help them make profits.

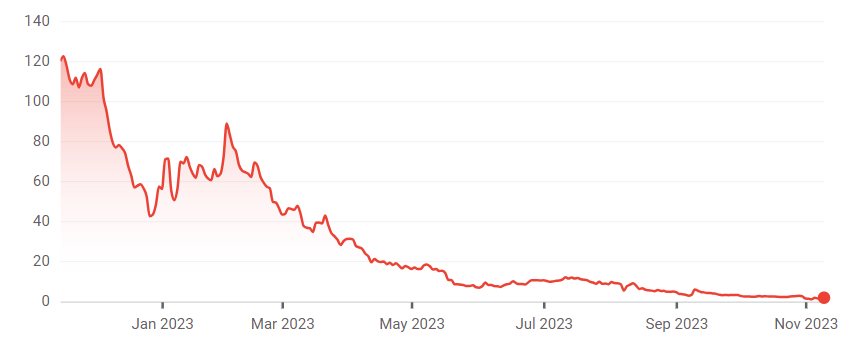

Other than their revenue, people were a little confused when they saw Neumann owned stakes in four of the properties leased to WeWork. He was on both sides of the deal! Because of all these concerns, their IPO fell out and the company began looking for more cash. Eventually they went public via a SPAC (Special Purpose Acquisition Company) deal in 2021. Amid all this drama, leadership changes ensued, with Adam Neumann stepping down, and the benevolent giant, SoftBank, stepping in to stabilize the ship.

Enter: Covid-19

As Covid-19 spread across the globe, demand for office spaces decreased and rent dropped. Their business model didn’t really make things better for them. Essentially, they were paying their long-term leases at old pre-covid prices while their tenants are paying them a lot less (post-covid prices). WeWork was buring through $300 million a quarter of cash.

Somehow, they managed to survive the pandemic. They focused on their flexible working space offerings and catered to larger firms. But all of these were merely survival techniques. Their recent earnings report from FY24 Q2 painted an alarming picture. WeWork’s long term lease obligations were worth $13 billion and projected future income from rents was merely worth $9 billion. A $4 billion gap is no joke. Further, the company maintained $205 million worth of cash, just a tenth of its current liabilities of $2.2 billion. They finally filed for bankrupty on Nov 6, 2023.

Within four years, they reached their peak valuation and declared bankruptcy. From a market cap of $47 billion to $41 million. Talk about highs and lows.

However, they’ve filed for bankruptcy under chapter 11 which means it’s not the end of the story. They’re probably going to have to cancel a ton of leases in order to continue business. The company announced that almost all (92%) of the lenders agreed to the transformation of secured debt into equity. This is a crucial step in their ongoing journey to restructure debt and indicates a joint effort to resuscitate the business and bring back the appeal it had during its initial years. Maybe the company’s story has just begun…

Leave a comment