If anyone has had more ups and downs than Ferrari driver Carlos Sainz this year, it’s Gensol Engineering’s stock.

There’s more to the story than what meets the eye. Let’s start by understanding the company. Gensol Engineering is a renewable energy solutions provider focused on end-to-end solar engineering, procurement, and construction projects. They deal with designing, engineering and basically managing all aspects of solar projects envisioned for development. They have three main business segments:

- Solar EPC: Under its Solar Engineering, Procurement and Construction segment the company manages projects from around the world.

- EV Leasing: This segment is modelled over buying and leasing EV cars to consumers like ride-hailing companies, to earn rental income on it. They are also working towards cementing relations with various corporate houses, industries and PSUs for electrifying their mobility requirements. More about this segment later.

- EV MANUFACTURING: Gensol acquired a majority stake in Gensol Electric Vehicle Pvt. Ltd., an EV manufacturing start-up, to venture into EV manufacturing. Their goal is the immediate electrification of consumer transport.

Let’s take a look at some of the key ratios in the business. All figures are from the financial report for FY23 compared to the previous year, FY22.

| Key Ratios | FY 2023 | FY 2022 |

| EBIDTA to Sales (in %) | 15.45% | 10.90% |

| PAT to Sales (in %) | 6.35% | 6.91% |

| Total Debt to Equity | 2.50 | 1.77 |

| Net Debt to EBIDTA | 3.916 | 4.081 |

| Return on Capital Employed (in %) | 7.00% | 13.00% |

| Return on Equity Ratio | 0.12 | 0.24 |

| Net Profit Ratio | 0.06 | 0.07 |

Some of these ratios have dramatically changed when compared to FY22. Why is that? The total debt to equity ratio increased 44% due to increase in working capital loan and an increase in term loan for the purchase of fixed assets. There was a 44% decrease in return on capital employed owing to an increase in the base compared to the previous year, higher sales implies more projects and hence greater capital requirements. The net profit ratio decreased 50% due to an increase in shareholder’s funds compared to the previous year, resulting from the issue of bonus shares.

Let’s take a look at the growth in terms of revenue and profits. The revenue grew 144.8% YoY, the EBIDTA rose 196% and the profit after tax rose 125%. Clearly it was a robust year for Gensol. India generated around 104.83 billion units (BU) of solar power in the calendar year 2023, a 10.17% increase from 95.15 BU generated in 2022. This shows us that solar energy is gaining popularily and adoption at a fast pace in India and as a result, paving the way for Gensol to grow and acquire projects.

The company also received approval for a ₹5.13 billion loan from IREDA for their EV leasing business to finance 3800 EVs, giving a boost to their new leasing segment. The EBITDA rose 196% YoY partially due to an increase in net profit and partially because of an increase in depreciation. They are investing in EV manufacturing production in Pune for their new segment, thus increasing depreciation on machinery. The cost of their raw materials were high in FY22 as the company received some balance of supply contracts. Since the costs were normalised in FY23, the COGS reduced and EBITDA increased. Higher depreciation charges on cars procured for leasing business is also a cause.

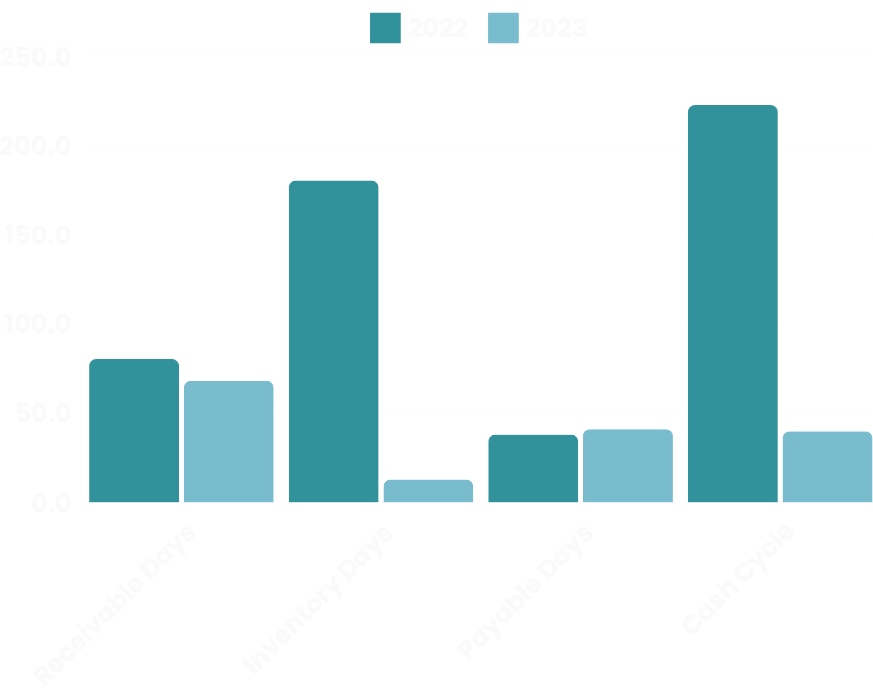

A decrease in the cash cycle from 222.5 days to 39.7 days implies that funding is being provided. The main component that increased cash cycle in 2022 was inventory days. An increase in revenues in 2023 led to a decrease in the average holding days of inventory and thus reduced the cash cycle in 2023.

Their inventory days were higher in FY22 since they had received some balance of supply contracts. These contracts imply that they had committed to purchasing raw materials in advance at set prices and held the raw materials in their inventory for the customer. This led the inventory days to be higher than it usually is. The OWC as a % of sales decreased from 62.9% to 25.8%, which means funding is being provided. With decreased working days and a lower cash cycle, the working capital required to support sales decreased. An increase in debt and borrowings helped fund the operations of the company.

They have gotten multiple projects and the stock market has reacted to this news in some expected and unexpected ways over the past few months. In the second week of March’24, Gensol Engineering won a ₹450 crore Battery Energy Storage Project by GNVL. The project is expected to provide electricity on an on-demand basis to Gujarat State’s DISCOMs during the peak and off-peak hours. However, despite winning this project, their stock price was down. A possible reason for this could be the fact that 1.64% of their shares are owned by Zenith Multi Trading DMCC, one of Hari Shankar Tibrewala’s companies. The ED froze assets worht ₹1100 crores in demat accounts linked to Tribewala because he ran a variant of the Mahadev betting app (a whole other story). Gensol did release a statement saying there’s no connection. Specifically they said, “Zenith, a passive shareholder since September 2022, holds less than 1.5% in Gensol and holds neither decision-making rights nor any involvement in the business and operational strategies of the company.” It doesn’t matter if what they said is true or false because their stock price fell anyway.

Things have been looking up since then… They completed a 160MW solar project, worth ₹128 crore, for Continuum Green Energy in Gujarat. This news led to the company’s stock hitting the upper circuit.

They also secured two new solar projects worth Rs 337 crore in Rajasthan and Maharashtra. The first order is for a 250 MW/350 MW ISTS (Inter State Transmission System) solar power project in Rajasthan, while the second project is of 50 MW/72.5 MW solar power project in Maharashtra.

They’re acquiring new projects, completing old ones. Everything seems to be working out in the Solar EPC segment. The EV leasing segment is an interesting one though. It’s a relatively new segment but in FY 2023, ₹215 Cr. EV Assets were leased. The business model is simple, they provide leasing solutions to those with mobility needs and earn lease rental income on it. A major customer for their leasing segment is the ride-sharing company, BluSmart.

It seems impressive that they acquired such a big player. But there’s a twist. BluSmart was co-founded by Anmol Singh Jaggi and Puneet Singh Jaggi (and one other person), the two of them are also the promoters of Gensol Engineering and hold managerial positions there. The biggest car supplier for Blusmart, though, is Gensol itself—accounting for two-thirds of its fleet. And BluSmart is Gensol’s largest customer in the leasing business by a distance. According to Ken, the leasing agreement seems to favour BluSmart at the expense of the minority stakeholders of Gensol. A revision to the leasing agreement to bring it at par with the market rates will raise costs and widen BluSmart’s losses by 3x to ₹215 crore.

The company’s stock price fluctuations seem to be influenced by both internal developments, such as project wins and completions, as well as external factors like regulatory scrutiny and legal issues surrounding shareholders.

Despite the financial successes and promising project acquisitions, market sentiment remains sensitive to these concerns, reflecting in the fluctuating stock prices. However, with a focus on transparency and leveraging its core competencies in renewable energy and electric mobility, Gensol Engineering holds the potential to steer through these challenges and emerge as a resilient player in the evolving energy landscape.

Leave a comment