Swiggy has released it’s draft red herring prospectus (DRHP) as it’s gearing up to make a market debut around November.

This comes almost three years after Zomato’s public debut in July 2021. I had previously analyzed Zomato’s DRHP, but there were no comparable companies in the Indian market, so it was benchmarked against international competitors like Deliveroo and DoorDash. However, given the differences between the Indian and Western markets, those comparisons were viewed cautiously. As expected, all of Swiggy’s metrics have been measured against Zomato’s, which has posed challenges for Swiggy.

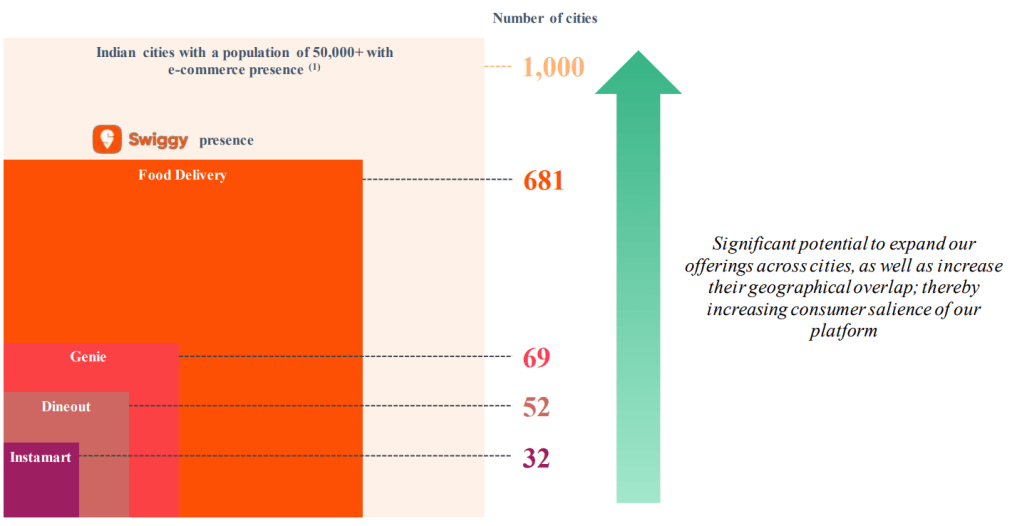

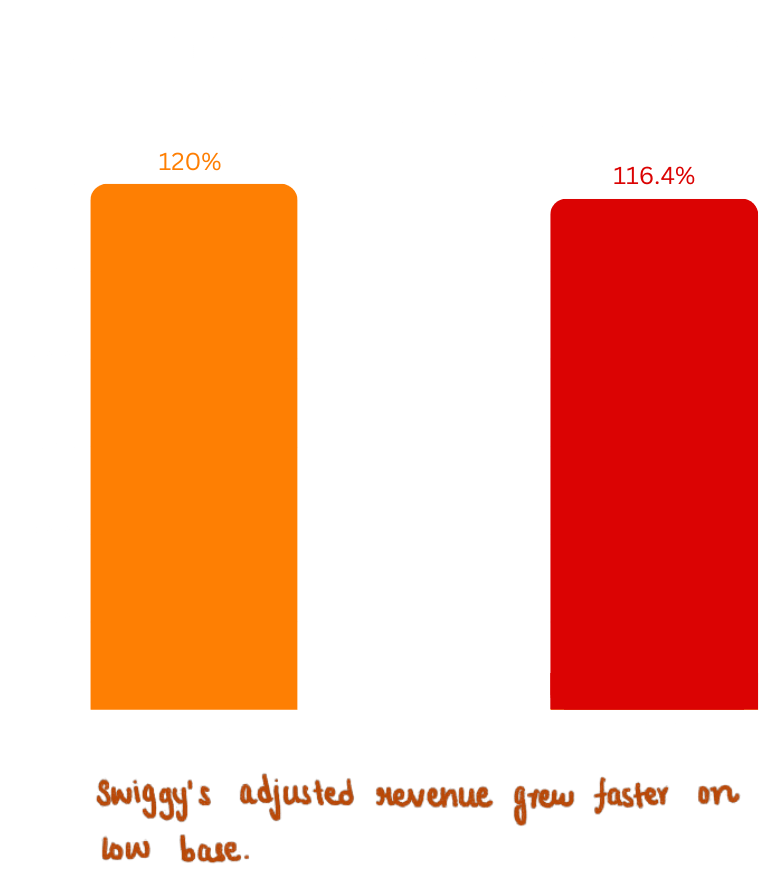

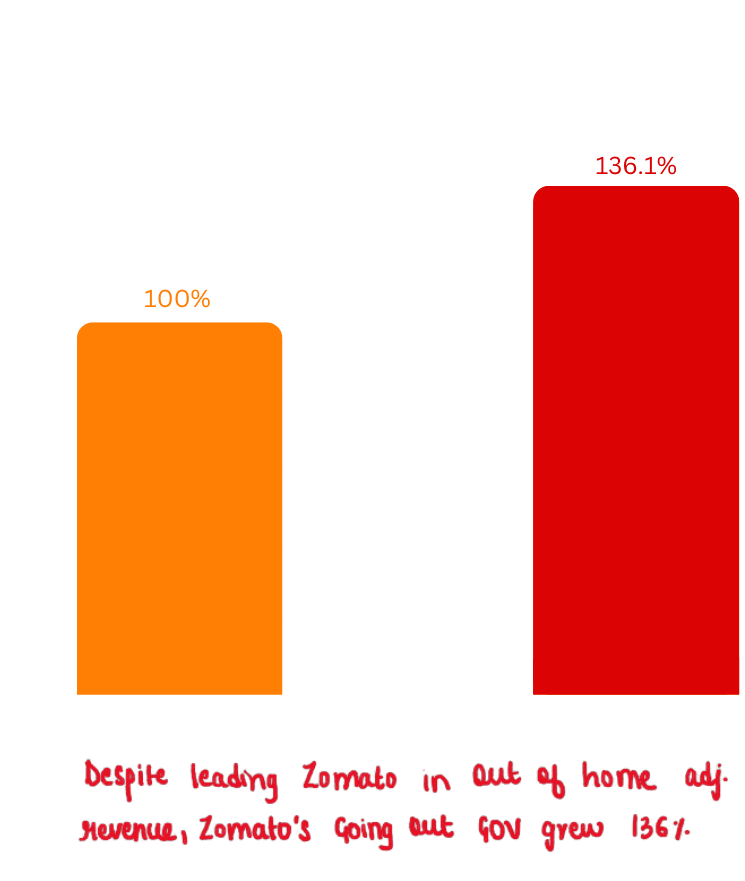

Swiggy is like the younger sibling who’s performance is always compared to the older sibling in school. Discussions surrounding Swiggy’s DRHP consistently reference Zomato’s performance. The issue is that there is a noticeable gap in their metrics, with Zomato establishing itself as the leader—not only in food delivery but also in other areas like qCommerce and Out of Home/Going Out, where Swiggy trails its rival.

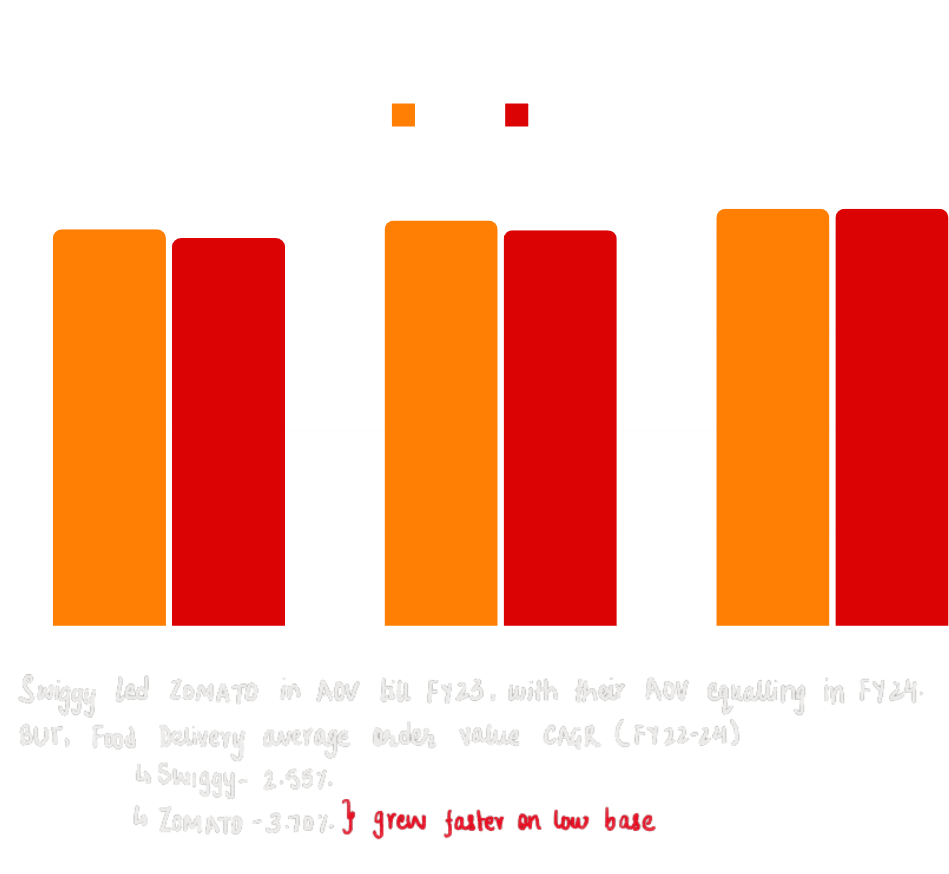

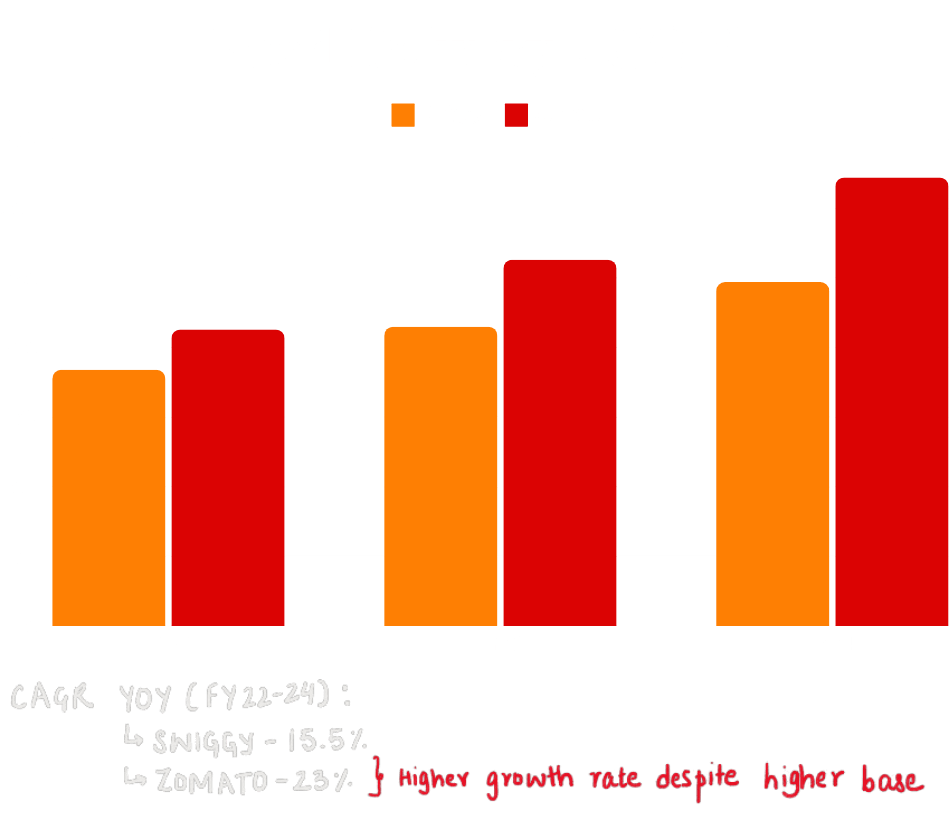

Let’s take a look at the comparisons between the two on the basis of various metrics in different segments.

In 8/13 metrics, Zomato leads Swiggy.

It’s not all bad for Swiggy. They have around 45% of the market and hasn’t lost its share to Zomato since 2022. Their Average Order Value (AOV) is also similar to Zomato’s. But that’s about it.

To be fair, Zomato’s numbers weren’t exactly that strong when they listed on the market. In fact, for the first few years they struggled with their numbers. Even till last year, they weren’t measuring up that well against Swiggy because their narrative wasn’t aided by their numbers. They have finally understood how to match their data to their story, resulting in a return of 160% over the last year.

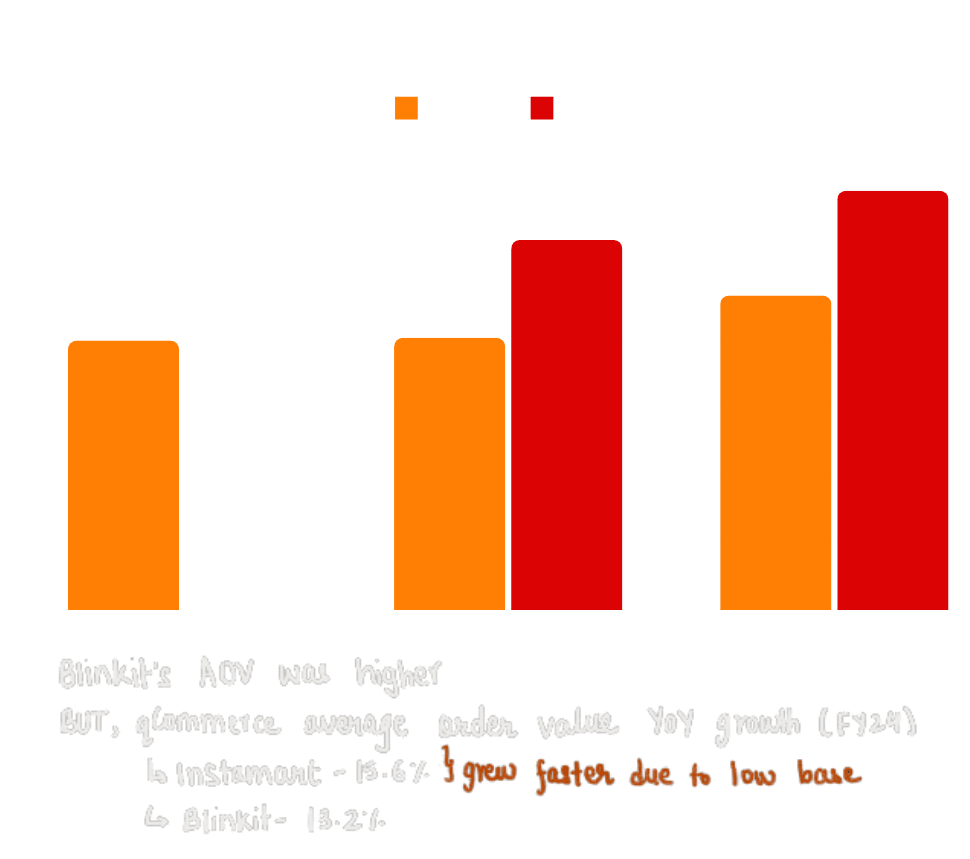

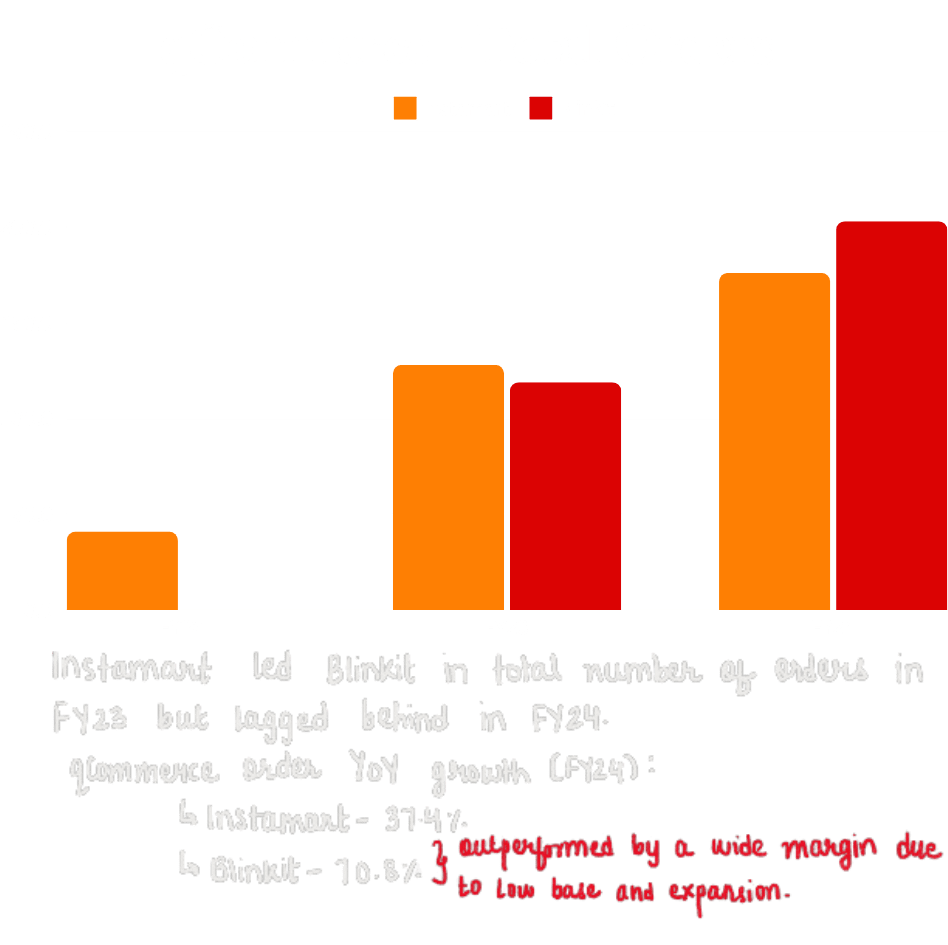

In qCommerce, Blinkit doesn’t enjoy a huge lead over Instamart in dark store count. However, Blinkit’s revenue from operations was 2.4x that of Instamart’s.

Blinkit holds more high-margin SKUs and they have 22,000 SKUs compared to Instamart’s 17,000. If you wanted, you could order a PS5 to your doorstep on Blinkit but not on Instamart. Blinkit’s proactive approach to capitalizing on sentimental and seasonal opportunities is resulting in increased traction for higher-margin SKUs and a boost in average order value (AOV). Since Blinkit sells more products, they’re able to negotiate better deals with manufacturers for FMCG and they charge brands more for advertising, compared to Instamart. Their bargaining power and advertisement cost will only rise if they continue their growth trajectory, further widening the gap with their competitors.

Aswath Damodhran, known for his work in the field of Valuation, believes that the power of a brand’s story drives corporate value, because it can persuade even cautious investors to take risks. Swiggy doesn’t have the numbers but their DRHP doesn’t tell a story either.

Maybe they need to extend their creativity beyond their app notifications to create a compelling narrative.

Leave a comment