You may have heard a lot of buzz around NBFCs, but lately the sector has been under a lot of scrutiny. Their roller coaster ride has been reflected in the markets as well: Bajaj Housing Finance’s IPO had a bumper listing, whereas Manappuram Finance faltered. The sector’s resilience is evident, but they’re also dealing with issues like rising non-performing assets and consequently, regulatory changes. Let’s take a look at the industry, set against the backdrop of rising unsecured loans.

Non-Banking Financial Companies or NBFCs are financial institutions that provide bank-like services but don’t hold a banking license. The biggest difference is that NBFCs aren’t allowed to accept demand deposits from the public and hence have to obtain their funding from other sources.

NBFCs have carved out a niche for themselves in India’s financial ecosystem. Their ability to serve underserved segments—rural areas, small businesses, and individuals excluded from mainstream banking—makes them indispensable, especially in a developing economy where financial inclusion is a critical challenge. Over the past decade, NBFCs have consistently outpaced banks in credit growth, contributing to India’s financial ecosystem.

This success is rooted in their operational flexibility. Unlike banks, NBFCs aren’t bound by stringent priority sector lending requirements. This allows them to explore new geographies, diversify their portfolios, and take calculated risks. In fact, credit outstanding for NBFCs reached an impressive ₹41.2 trillion in FY24, growing at a compounded annual rate of 11.9% over the last four years. Projections suggest this momentum could take the figure to ₹55.5 trillion by FY26, reflecting a CAGR of 16-18%.

India’s focus on financial inclusion is increasing, however, a large section of the population is still unbanked. Rural areas account for 47% of India’s GDP but only receive 9% of the overall banking credit as at March 31, 2024. This shows the vast market opportunity for banks and NBFCs to lend in these areas. Credit to metropolitan areas has decreased over the past few years with its share decreasing from 66% as at March 31, 2018 to 57% as of March 31, 2024. During this period, credit share for semi-urban areas has gone up from 12% to 14%.

The primary source of funding for NBFCs continues to be bank borrowing. Share of bank borrowing as a percentage of total funding has increased from 29% at the end of FY22 to 38% at the end of FY24. Banks’ credit exposure to NBFCs also remains healthy as it grew at 14.28% between March and December in 2023. The share of NBFCs in the overall credit exposure was 9.6% as at December 2023. Bank funding is expected to grow and might see a higher share in the borrowing mix for NBFCs.

The sector has had to show a lot of resilience to get to where it is today. Back in 2018-19, a crisis unfolded when IL&FS, a giant in the NBFC sector, defaulted on its obligations. The fallout sent ripples throughout the sector and raised questions about the stability of these companies. After the crisis, smaller slowed down their lending activity and focused on improving asset quality. Just as they were recovering, the pandemic struck, presenting funding challenges and slower credit growth in the industry.

NBFCs are growing fast, but they’re also leaning heavily on unsecured loans. Unsecured loans are basically loans that are not backed by any collateral, such as property or other assets. They’re just supported by the borrower’s creditworthiness.

Unsecured loans have been the star of the NBFC growth story in the past few years, driven by the demand. However, there is also a high risk associated with these loans. The lack of collateral makes these loans accessible to more borrowers but also exposes lenders to a much higher default rate. In fact, one-third of retail slippages now originate from unsecured portfolios. COVID-19 escalated asset quality deterioration further owing to restricted movement, which affected collections. The government announced moratrorium and restructuring schemes which served as a temporary relief and delayed the asset quality concerns. Eventually the gross non-performing assets (GNPAs) in segments such as auto, microfinance and MSME raised eyebrows in 2021.

Despite this, NBFCs remained resilient and continued to expand. Between Fiscal 2021 and Fiscal 2024, they significantly grew their loan portfolios across various segments, including low- and middle-income housing loans, microfinance institutions (MFI), commercial vehicle loans, two-wheeler loans, small business loans, and personal loans. They raised ₹7.4 trillion during this period to support their growth. Further, CRISIL estimates that they will require funds around ₹10.2 trillion between FY25-FY27, financed through a mix of debt, equity and securitization.

I’ll focus on 3 categories of unsecured loans that have shaped the NBFC growth story: Small Business Loans, Consumer Durables Financing and Personal Loans. These categories highlight the opportunities available in the unsecured lending space but also reveal the associated risks that companies must navigate.

Small Business Loans

All loans with ticket size lower than ₹1 crore extended to MSMEs, irrespective of the turnover of the entity, have been classified as small business loans. As of March 2024, outstanding small business loans stood at ₹13.1 trillion, registering a CAGR of 15% between FY19 and FY24.

A major growth driver has been the non-loan against property (LAP) segment, which includes both secured and unsecured loans. NBFCs have increasingly directed funding toward unsecured loans, due to the revival of economic activity, improving cash flows, and improved underwriting capabilities. NBFCs increased their funding in the unsecured segment while restricting lending in the LAP segment owing to the asset quality stress of the previous years. Along with immense potential, the unsecured segment also has higher credit risks. Unsecured loans consistently accounting for 22-24% of small business lending portfolios.

Looking ahead, small business loans are projected to maintain their growth trajectory at a 15% CAGR, possibly reaching ₹19.8 trillion by FY27. Increasing credit penetration, technological advancements and the entry of new players are some of the factors that have contributed to this growth. Moreover, less than 10% of India’s 70 million MSMEs currently have access to formal credit, and the credit gap is estimated at ₹103 trillion as of FY24, which underscores the opportunity for NBFCs to expand their footprint in this segment.

However, there are also a lot of challenges in this segment. MSMEs have limited access to formal credit and their lack of collateral and insufficient credit history make it challenging for them to secure loans. These borrowers are also often susceptible to industry-specific challenges and volatility which poses some hurdles in risk assessment and mitigation. Additionally, the risk perception associated with unsecured lending requires NBFCs to develop robust risk assessment and mitigation strategies. The GNPA ratio for the industry is pretty high at 4.8-5.2%. ICRA projects gross non-performing assets (GNPAs) for MSME loans to weaken by 30-50 bps at the end of FY25.

Consumer Durables Financing

Consumer durable loans are a special category of personal loans that is given for items that are expected to have a relatively long useful life after purchase.

The consumer durables market in India continues to exhibit growth, fueled by rising demand for electronics, appliances, and other household goods. CRISIL estimates the market size for consumer durables financing to reach ₹812 billion at the end of FY25, representing a robust growth rate of 26-27% over the previous year.

NBFCs have emerged as key players in this space, benefiting from their ability to provide flexible lending solutions catering to the specific needs of their customers. The outstanding consumer durables loan book for NBFCs grew at a CAGR of 21% between FY21 and FY24. The NBFC consumer durables market is projected to reach ₹899 billion growing at a CAGR of 25-28% between FY25 and FY27.

A major growth driver is the demand from prime and below-prime consumers, who are increasingly opting for NBFC-financed purchases over traditional bank loans. Low-ticket-size growth driven by fintechs are also contributing to the segment’s expansion.

NBFCs hold a competitive edge in consumer durables financing due to their strong partnerships with brick-and-mortar retailers, enabling point-of-sale (POS) financing. These loans are processed directly at retail outlets or showrooms, making them convenient for customers who prefer EMI schemes over traditional bank loans.

Post-pandemic, NBFCs have increased their market share in consumer durables financing, driven by aggressive credit disbursements, penetration into untapped markets, and their ability to provide tailored solutions. While banks have retained some market share through credit cards, NBFCs are competing by offering more accessible and flexible financing options.

Despite the growth potential, NBFCs face rising competitive pressures from banks and fintechs, as well as increasing funding costs. The ease of accessing loans and credit increases the risk of defaults, leading to higher NPAs in the consumer finance sector (the industry GNPA ratio is 6.8-7.4%). Moreover, increased competitive pressures from banks and rising funding costs are squeezing margins in this segment, expected to drop by 25-45 bps in FY25.

Personal Loans

A personal loan is an unsecured financial product that allows individuals to borrow funds for various purposes. In India, the personal loans segment has seen significant growth in recent years, with NBFCs playing a pivotal role in meeting the rising demand across diverse customer segments.

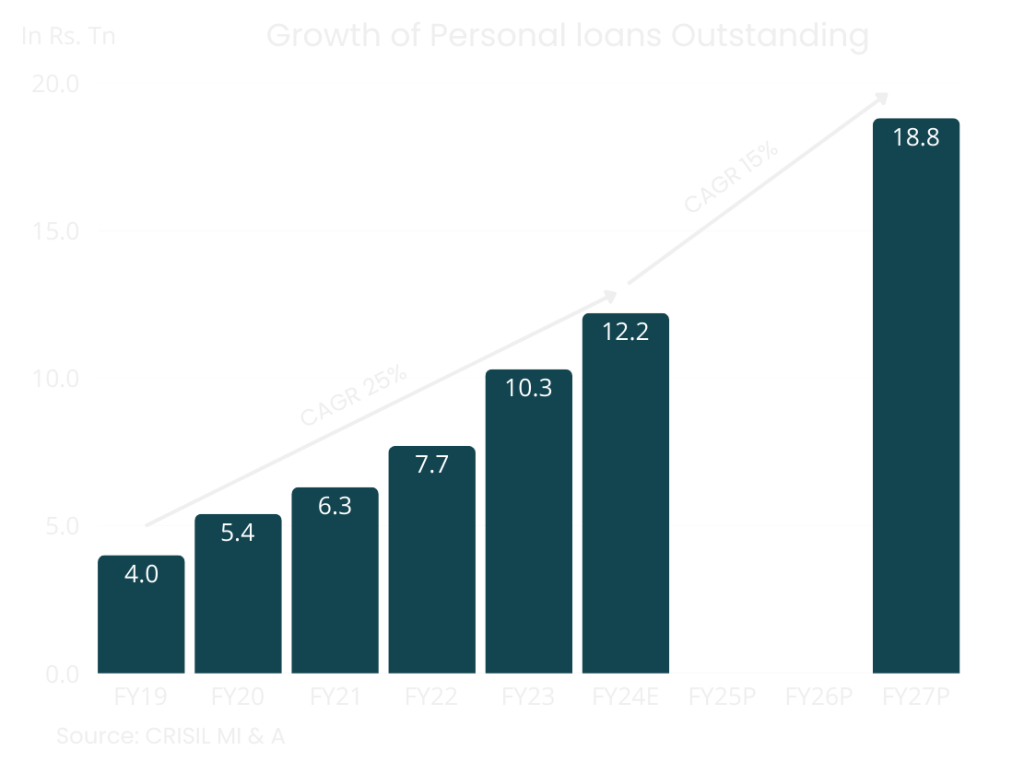

The personal loans market rebounded strongly post-pandemic, driven by increased consumer spending and pent-up rural demand. Outstanding personal loans stood at ₹12.2 trillion in fiscal 2024, reflecting healthy growth, and are projected to surpass ₹18.5 trillion by fiscal 2027. This growth has been due to changing consumption patterns, improving income profiles, and the growing preference for retail loans.

NBFCs have consistently outpaced banks in personal loan growth, benefiting because of their lower/no collateral requirements, easier documentation and network in underserved areas. Personal loans grew sharply between fiscal 2019-24 at a CAGR of 25%, which is expected to slow down to 15% between fiscal 2025-27. Their ability to penetrate deeper into Tier 2 and smaller cities has allowed them to cater to self-employed customers, a segment often underserved by traditional banks.

In contrast, banks, with their focus on salaried customers and Tier 1 cities, have achieved better asset quality performance due to lower cash-flow disruptions among their borrowers. While banks recorded credit growth of 16-18% in fiscal 2024, NBFCs continued to expand at a faster pace, increasing their market share in the segment.

The share of personal loans in the overall NBFC loan mix is increasing and is expected to reach 35% by FY25. However, the unsecured nature of personal loans makes it more vulnerable to defaults. NBFCs face challenges due to their higher exposure to the self-employed segment and lower-tier cities, which traditionally exhibit weaker asset quality. Due to the higher rate of interest, it’s challenging to achieve a balance between lender profitability and affordable interest rates for consumers. Further, given the unsecured nature of these products, defaults and delinquencies can be a significant concern for lenders.

Overall risks

Delinquency levels among borrowers with loans below Rs 50,000 remain notably high. NBFC-fintech lenders, which hold the largest share of both sanctioned and outstanding loans in this segment, also have the second-highest delinquency levels, only surpassed by small finance banks. Moreover, Vintage delinquency—defined as the percentage of accounts that become delinquent (90-plus days past due) within 12 months of origination—stands at 8.2% for personal loans.

Banks still remain a primary source of funding for NBFCs which is a cause for profitability concerns. Funding costs are expected to rise by 25-45 bps at the end of FY25, squeezing profitability across segments as GNPA remained steadily above historical levels. According to ICRA, the increase in credit costs could be as high as 100-120 bps. The increase in unsecured loans makes NBFCs a riskier asset for banks.

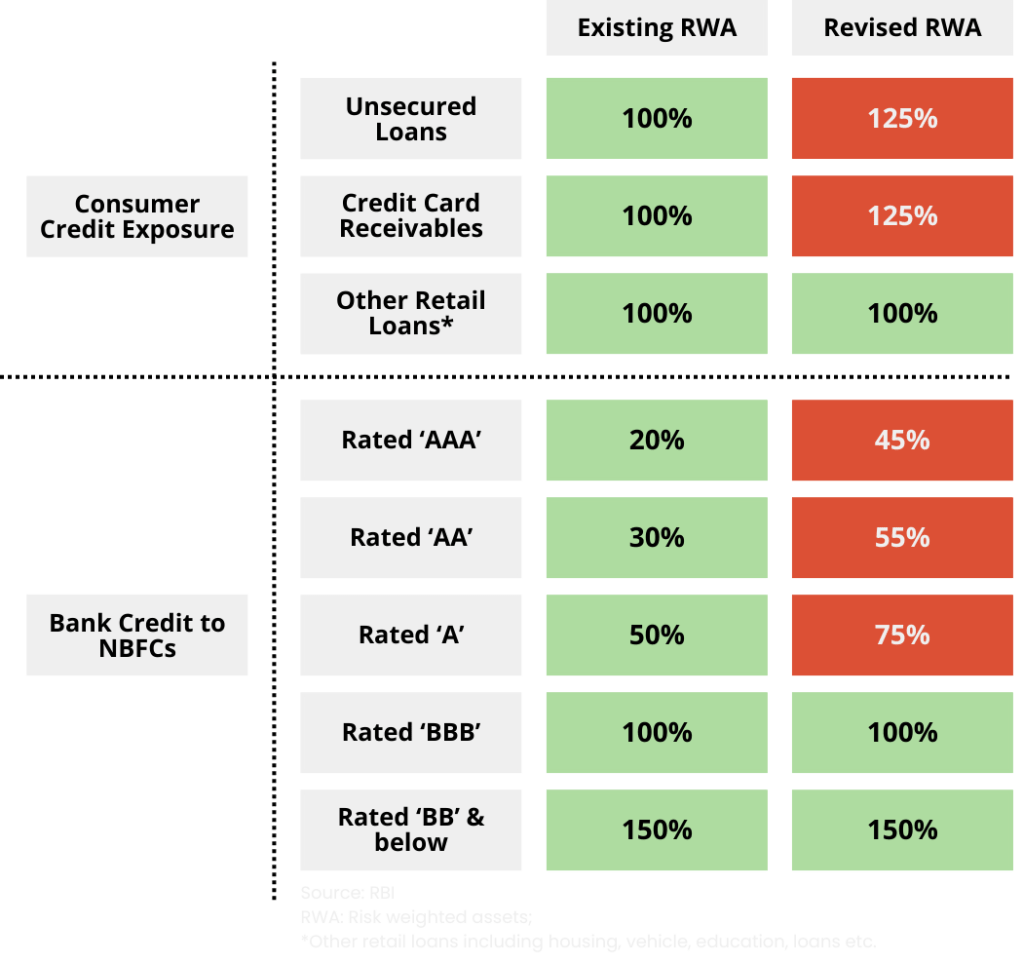

The RBI noted the steep growth of unsecured loans against the backdrop of a rising interest rate environment and decided that it was time to step in. They began by cautioning the lenders regarding the potential risks associated with the growth in unsecured loans. In November 2023, the RBI introduced a circular to deter the growth of unsecured loans. Per the circular, the risk weight for all consumer credit exposure for both commercial banks and NBFCs was increased by 25% (including credit card receivables for commercial banks and excluding housing, vehicle, education and home loans). Also, the risk weight for exposure for banks to NBFCs was also increased by 25%.

In the context of NBFCs, risk weight is the percentage assigned to different types of loans or assets to reflect their level of credit risk, which helps determine the amount of capital an NBFC must hold to cover potential losses. Suppose an NBFC is giving out a loan of ₹100 at a rate of 12%, the interest in this case would be ₹12. If the risk weight is 100%, the bank would have to set aside 100% of 12% of the total loan i.e. ₹12.

The retail credit growth of NBFCs has slowed down due to the high base effect and increase in risk-weight. What’s surprising is that, despite this slowdown, the systemic risks are rising. Unsecured retail lending growth has also fallen, from 27.0% to 15.6%, reflecting a tighter regulatory environment and increased lender prudence. The GNPA ratio for NBFCs stood at 3.4% in Sep’24 and that of NBFC-ML stood at 5.3%, with a sharp rise in write-offs—especially among private sector banks—masking potential asset quality deterioration.

The RBI’s increase in risk weights for unsecured loans and bank exposure to NBFCs has squeezed profitability across the sector, while delinquency in personal loans remains concerning. Borrowers with multiple live loans, including credit cards and personal loans, pose risks, as defaults in one category often have a domino effect into secured loan delinquencies. Nearly half of the borrowers availing personal loans have another live retail loan outstanding. 11% of borrowers with personal loans under ₹50,000 already had an overdue personal loan. Nearly 60% of the customers who availed a personal loan had more than 3 live loans at the time of origination in FY25. These trends signal stress in borrower repayment capacity, particularly in the unsecured segment.

Simultaneously, NBFCs are navigating a slowdown in credit growth, which fell to 16% in fiscal 2024 from 22.1% a year ago. Rising impairments, increasing capital requirements, and reduced lending growth creates a pressing need for the sector to balance risk management with sustainable expansion strategies. In the MPC meeting in October, ex-RBI governor Shaktikanta Das said that the high risk, high growth approach some NBFCs are adopting could be counterproductive for their health.

The situation with NBFCs presents a clear paradox: on one hand, NBFCs play an essential role in increasing credit penetration and supporting underserved segments, which in turn drive financial inclusion and economic growth. On the other hand, the rising accumulation of NPAs, especially in unsecured loans, increases systemic risk and stress within the sector. It’s tough to have the best of credit penetration and stable financial institutions so balancing these objectives remains a problem.

Leave a comment