Lately, I’ve noticed quite a few headlines along the lines of “XYZ company files for a confidential IPO.” After seeing the term pop up multiple times, I couldn’t help but get curious as to what exactly is a confidential IPO, and does it actually give companies any real advantages?

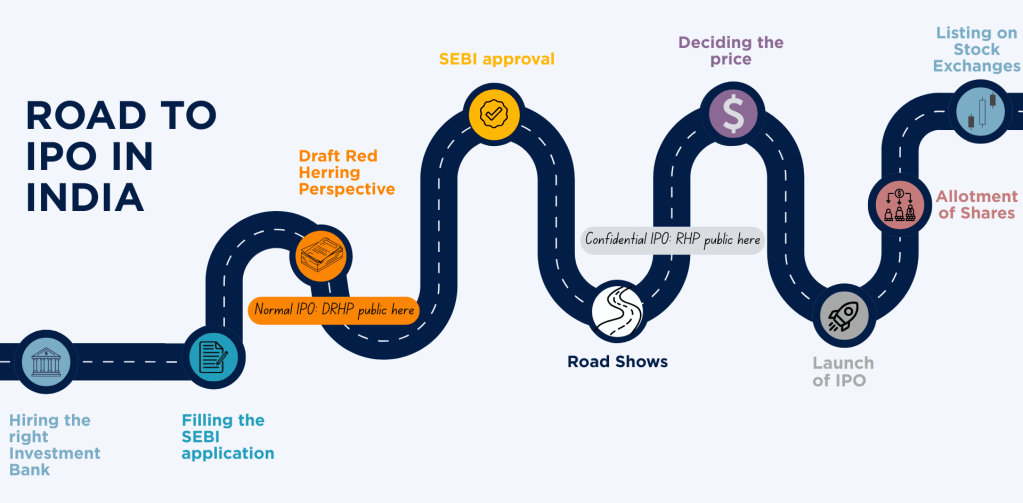

Quick recap, Initial Public Offering (IPO) is the process that companies go through before they can go public and list their shares on the stock market for the first time. There are a lot of steps involved in the process. Very briefly: a merchant banker evaluates the company, company files a Draft Red Herring Prospectus (DRHP) contained company details with SEBI, SEBI reviews and the company waits for them to green light it, they open subscriptions for their shares and the company hopes to enjoy a great first day on the markets.

Coming to confidential IPO, a company can first submit its Draft Red Herring Prospectus (DRHP) to SEBI privately. Normally, when a company files its DRHP, all financials, risk factors, and business details immediately become public. allows them to go through the regulatory review and make changes without competitors, media, or the market watching every detail. The information is made public eventually but only once the company is ready to move ahead. The final version (aka the Red Herring Prospectus) is made public for investors. It’s a relatively new option in India, which was introduced by SEBI in 2022.

Tata Play was the first company to use this option of a confidential IPO in December 2022. They eventually withdrew from the public issue, without any of the information in their DRHP being made public . Swiggy and Vishal Mega Mart both opted in for confidential IPOs and opened successfully, which gave other companies confidence to choose this option. A lot of companies have filed confidential IPOs and are currently awaiting approval from SEBI including: Physics Wallah, Tata Capital, Imagine Marketing (Boat), Groww, Shiprocket, Manipal Payment & Identity Solutions, Shadowfax Technologies, Meesho.

Think of SEBI and the company filing for an IPO as a couple engaged to be wed. If a couple is engaged for 3 or more years and still haven’t had their wedding, people start to question it. Is there something wrong in their relationship? Do they not want to get married? A lot of unnecessary comments even though they just want to wait till the time is right for both of them. Similarly, if a company files its papers with SEBI and doesn’t make its market debut in a few months, people start thinking something is wrong in the company, they ran into some issues and assume the worst.

If the couple doesn’t announce their engagement to the world and only tells them once they have decided on the date, people won’t know the duration of their engagement and no one will make unsolicited comments. That’s one of the advantages of a confidential IPO. The market can’t judge how long after submitting the documents a company chooses to go public. This won’t cloud the investors’ minds with unnecessary judgement.

This flexibility matters a lot, because picking the perfect IPO date is a bit like locking in a wedding date two years in advance for an outdoor ceremony, without any backup plans. You can check past weather patterns and hope for the best, but there’s no way to guarantee the skies will cooperate on that exact day. Markets are the same; conditions can shift suddenly and you can’t correctly pick a date to hit the market 6 months prior. Confidential IPOs provide exactly this flexibility. If a company, during their roadshow, sees that their is sub-optimal demand, they can pull out of the process before committing to a listing. All this without any of their financials or data being made public. As opposed to this, during the regular IPO process, you have to commit during the DRHP filing.

If you file for an IPO the normal way, SEBI gives you 12 months after their approval to debut in the market. This time period is 18 months for confidential IPOs. And you get the 18-month timeframe without any judgement from investors.

DRHP documents have a of disclosures including financial overview, business overview, KPIs, ratios, business strategies etc. This is very sensitive information from a competition point-of-view. Even if the company is certain about listing on the market, they want to delay the retain the competitive edge by keeping this information private until the very last moment possible. Especially for fast-moving sectors like IT and new-age companies, it helps the companies keep this information private for as long as possible.

To sum it up, the benefit of a confidential IPO is a flexible timeline, gauging market interest and launching at the right time and not unnecessarily disclosing business strategies and financials to your competitors.

However, there’s a slight disadvantage. Especially in a market like India, where this is a new concept, it might lead to some uncertainty in investors’ mind due to the opacity in the process (as compared to a regular IPO). This could lead to an “underpriced” listing for the company.

Regardless, this is an option that’s been available in developed markets such as US and UK for a while now. Indian companies are slowly gaining confidence in the process and seeing the merit in it. Urban Company is the latest company who chose the confidential route and is now open for subscription.

What route would you choose if you were to take your company public today?

Leave a comment