Doppelganger

(n.) a spirit that looks exactly like a living person, or someone who looks exactly like someone else but who is not related to that person.

Doppelgangers in the share market can be when two companies have similar names. This is a lot more common than you think and causes a lot of confusion among investors. I’ve picked out some of the famous instances from recent past where this has happened. It may sound like a comedy of errors, unless you punted on the wrong horse!

Zoom

Let’s go back to the beginning of the pandemic, when there were nation-wide lockdowns around the world. Everyone was trying to figure out and adjust to work from home and online school. This helped in the discovery of new businesses and companies that aided the shifts to online platforms. One such company is – Zoom. Not many had heard of their name before March 2020 and suddenly it became so popular, that it’s a verb today.

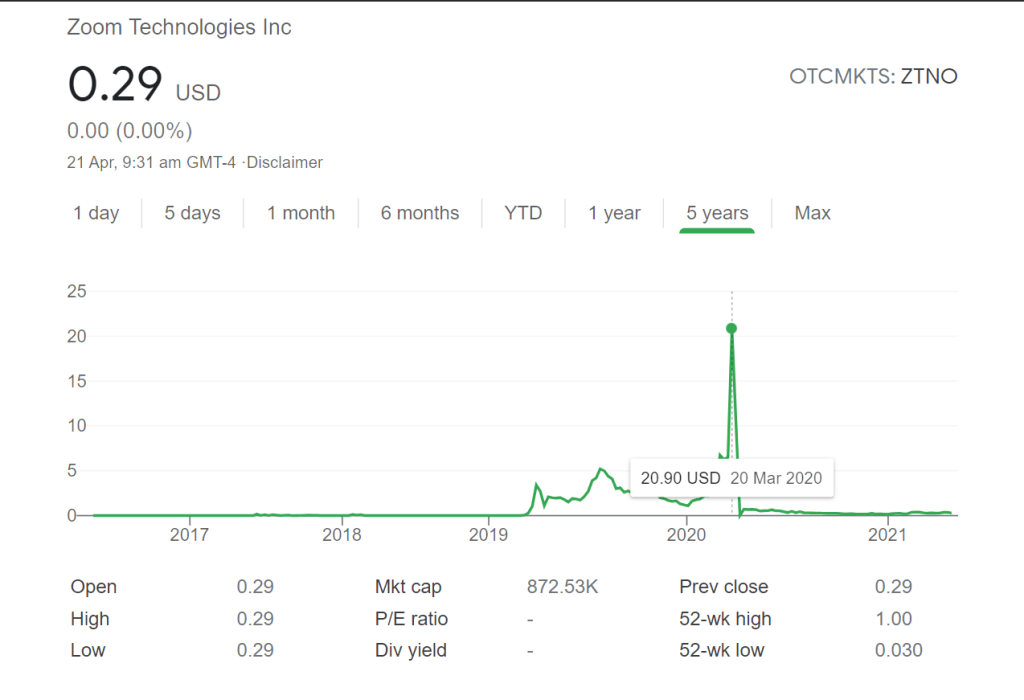

To cash in on Zoom-mania investors flocked to buy the stocks of Zoom. Lots of people bought the shares of ZOOM Technologies listed on Nasdaq. Their share prices surged, and rose by more than 240%. WOAH.

BUT, Zoom technologies was some other company altogether. They had meant to buy the stocks of Zoom Video Communications. What a blunder!

Luminar Technologies

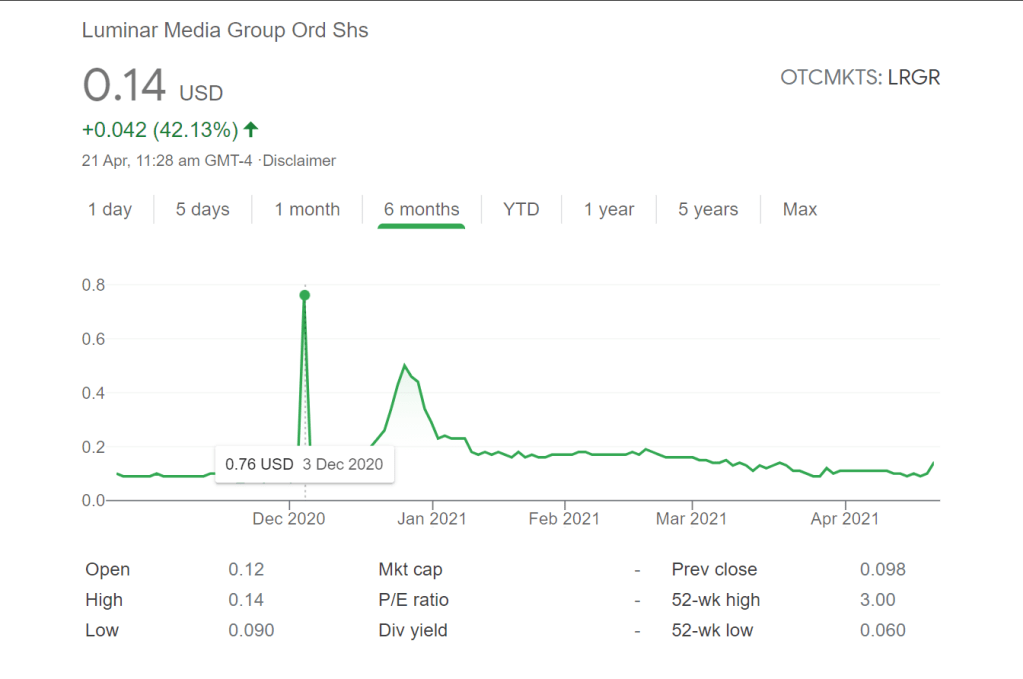

Luminar Technologies makes software’s and technologies for self-driving cars. They went public in December 2020, which earned the 25-year-old founder, Austin Rusell, billions of dollars. Soon after they went public, the stocks of Luminar Media Group skyrocketed. It’s stocks surged more than 1000%. They had an overwhelming trade traffic. People bought the wrong stock, AGAIN!

It could be because of a similarity in the ticker code- Luminar Tech’s is LAZR and Luminar Media’s is LRGR – Fat Fingers! Or simply because investors got confused between the names of the two companies. Just like when it’s confusing for everyone if there are 2 boys named Arjun in a class.

Bombay Oxygen

As India grapples with the second wave of the coronavirus pandemic, there has been a huge demand for Oxygen, drugs (like Remdesivir), and other COVID related supplies. The companies involved in manufacturing these have a lot of pressure to keep up with the demand. And the investors are trying to keep up with these trends.

The shortage of medical oxygen has led to the prices of oxygen cylinders almost doubling! That’s why investors are buying stocks of companies that manufacture oxygen in order to make profits. They’re so eager to buy such stocks that investors are picking any stock which has “oxygen” in their name.

Bombay Oxygen has really enjoyed this. They’ve been gaining a lot of attention in the stock market. It has Oxygen in its name, sounds like a gas manufacturing company. Here’s the twist, it’s actually a Non-Banking Financial Company (NBFC)!! They used to manufacture and supply industrial gasses but they stopped some time back. But the investors didn’t read this much about it.

If you go to their website, they have given an introduction which includes:

The Company’s primary business was manufacturing and supplying of Industrial Gases which has been discontinued from 1st August, 2019. The Company owns substantial financial investments in the form of shares, mutual funds & other financial securities and the income from such financial investments is the source of revenue of the Company.

But in the investors’ defence, if you go to the subpage titled “products” on their website, it says “Manufacturer and Dealer of Industrial Gases.”

Signal

Remember when WhatsApp announced it’s new privacy update and it faced scrutiny from millions of people? People were threatening to quit WhatsApp and switch to (so called) safer apps like Telegram and Signal. And a few people actually did switch to those apps. But they didn’t exactly stop using WhatsApp. Anyway, apps like Signal were gaining a lot of users and doing very well.

These 2 words by Musk were enough to give a company a market valuation of $390 million. When he tweeted this, many people started buying the stocks of Signal. It pushed Signal Advance’s rally 6350% in 3 trading days! Funnily enough, stocks of the Signal they intended to buy isn’t even a public company! Investors had bought the shares of some other other company altogether and made it worth $3 billion while they are under scrutiny for not publishing their financial results and last reported revenue for 2015 and 2016 was Nil!

Clubhouse

Yet another stock that skyrocketed because of the technoking:

One tweet is all it takes

Rise in stock prices

Possibilities

That looks like all you need

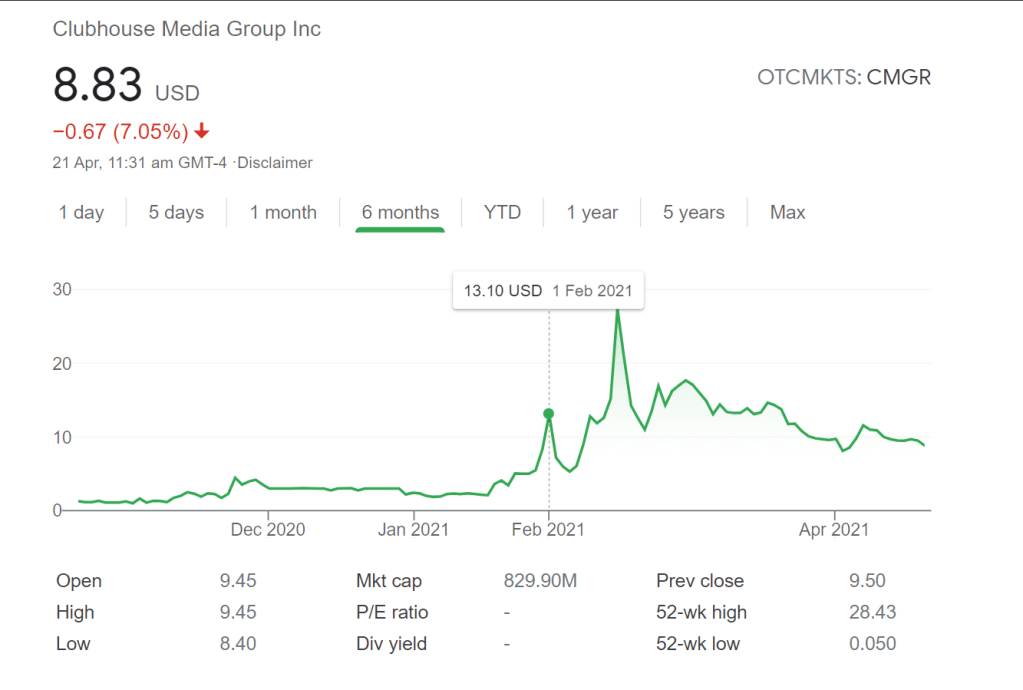

The clubhouse Mr. Musk is talking about is the audio chat app for iOS users. Elon Musk hyped it by this tweet, taking the world by storm. That night, while he chatted on the Clubhouse app, the stocks of Clubhouse Media Group soared more than 100%.

Bloomberg says, Clubhouse Media Group offers management, production and deal-making services in the social media influencer space. And… it’s the wrong stock again. Clubhouse app is a private company and not yet publicly traded

Maybe this isn’t such a bad investing strategy. Next time there’s a major IPO, look out for the doppelgangers. But be sure to buy them early on so that you can make huge profits :p

Leave a comment