Imagine you’ve found your dream home, it’s in the perfect neighbourhood and the timing couldn’t be better. It’s everything you ever wanted and more. You place an offer for the house and send baskets of home-baked cupcakes and cookies to the seller, screaming “pick me!” And then… someone offers a price 20-25% higher than your offer. It’s not yours anymore. Oh the horror!

The housing market in US has been going through and boom and many buyers can relate to this sentiment.

Let’s start at the very beginning of the pandemic. When the Covid cases were rising and the country was under lockdown, economic future of the country looked bleak. The central bank and government tried to come up with ways to soften the impact. One of their goals was to increase liquidity in markets. Greater liquidity means more money in the economy.

For this, they decreased the lending rates. The cost of borrowing was near 0% at one point. So it was super cheap to borrow money.

se now

This was coupled with a shift in needs due to the pandemic. Work from home has become the new norm and some employees might never go to physical offices. For this, you need a separate office space in your house. Those with children also need extra rooms as a majority of the year was spent online or in the hybrid model.

Both of these factors encouraged people to buy houses. Loans were readily available at low prices and mortgages were also low.

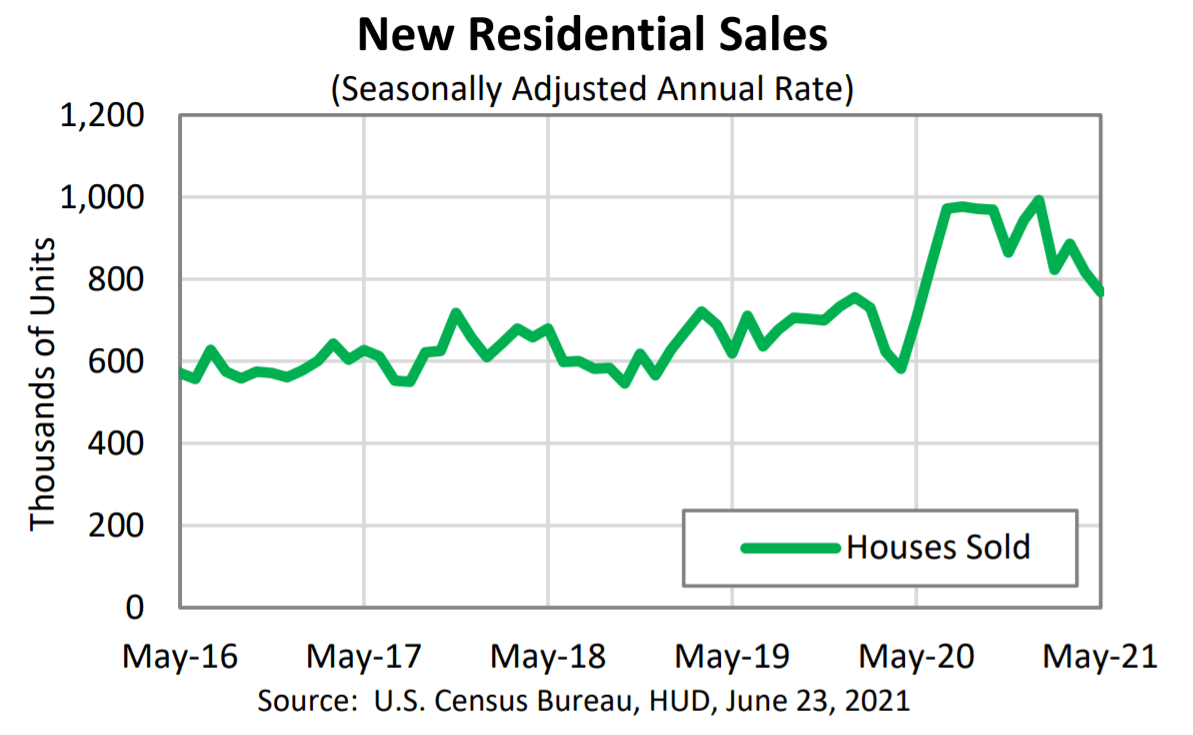

The new residential sales were mostly stable through the years. However, in 2020, an exponential increase can be seen which has mostly persisted since. The FED reduced interest rates in March’20. The effects of this are reflected in the rise in house sales beginning around mid-April/ May.

According to a census by the government of US, the average sales price of privately-owned houses sold and for sale, in 2019, was $383,900. The Average price for the same rose to a whopping $430,600 in May’21.

What they probably did not expect was the boom and intense competition that would follow.

The number of house is less than the number of people looking to buy houses. Multiple people putting offers on multiple house, offering high prices, in hopes that they’ll get at least one house. Just think about how many of your favourite YouTube vloggers have bought a house in the pandemic.

There are always winners and losers. So who are they in this case?

Investors are winning and the middle class is losing out…

In 2010, the mortgages were high. Hence people were unable to pay off the mortgage and their houses were taken away and put into foreclosure. This was happening in large numbers, thus creating a housing glut. After the housing crash in 2010, the government incentivised Wall Street to step in. They launched a pilot program to allow private investors to easily purchase foreclosed homes by the hundreds from Fannie Mae, the government agency in 2012. These investors would rent out their homes and create more housing in areas heavily hit by foreclosures.

It worked really well. Between 2011-17, large private-equity groups and hedge funds and other investors, spent $36 billion on more than 200,000 homes across America. In one Atlanta zip-code, they bought 90% of the 7500 homes sold between Jan’11 and June’12. Their main focus is to buy single family homes and rent them out. They claim that the target audience for them are millennials because they prefer “experiences over assets.”

What’s happening right now? These firms are competing with middle class people to buy houses. They’re keeping a hawk eye on every house and are paying 20-50% above the asking price, hence outbidding normal home buyers by a large margin.

Blackrock is one of the leading firms leading this. Who are they? The world’s largest asset manager. They currently have assets worth over $9 trillion. They’re boxing families out of their American dream and turning homes into rental units.

If you look at numbers, Blackrock and other institutions don’t really own those many houses. Out of 140 million housing units in America, around 80 million are stand-alone single-family-homes. Out of these, 15 million are rental properties (approx.). Further, only around 300,000 of these are owned by investors.

However, the houses that they own are concentrated in specific neighborhoods. In the neighborhoods that they own houses, they own a large percentage. Enough to influence the rent and raise the amount payable. These firms would’ve researched neighborhoods which would serve as an attractive location in the future for various reasons (Think: schools, metro-cities etc.). Now they’re charging high rent from those desperate to live in these locations.

Investment firms and private investors stand winning. They have the capacity to pay much higher than middle class has to offer. Common people are losing out because they are not able to reap the benefits of low interest rates to buy the American dream. They are in direct competition with large firms, richer than these buyers.

Leave a comment