Here’s what Zomato delivered other than food to customers:

- One of the biggest food delivery companies in India: They have over 100,000,000 downloads on their app!

- Sales: Their revenue from operations in the first 9 months of FY21 (₹13,013.49 million) was almost equal to the total revenue from operations of FY19 (₹13,125.86 million). Note: business was bleak in the first two quarters of FY21 due to nation-wide strict lockdown. (Source: Zomato’s DRHP)

- It’s still not profitable: Although,,, They did significantly cut down their losses during the pandemic (approximately 70%). That’s a start!

An Indian company, that is not profitable, going public… How is that possible?

SEBI rules made it almost impossible for loss-making companies to list on stock exchanges. Almost impossible, so there is still a slight possibility. If loss-making companies have to go for a listing, they have to float 75% of their net public offer to Qualified Institutional Buyers (example; Mutual Funds, insurance companies, alternative investment funds etc.). So, only 25% of the offer can be subscribed by retail investors.

SEBI came up with this rule to protect retail investors. But if you look at this in the present scenario, they’re depriving retail investors from making profits. If a loss-making company’s IPO shoots up 50%, there will be barely any stocks for retail investors to trade and make profits. Also, most startups now-a-days are not profitable for many years in the beginning. This makes it harder for them to list on the Indian Stock exchanges. Maybe these rules need to be changed with time.

Let’s look at Zomato’s numbers in comparison to Jubilant FoodWorks, the parent company of Domino’s.

| Company | Google PlayStore Rating | Google PlayStore Ratings | City Presence | Market Valuation (₹) | Revenue for FY20 (₹) |

| Zomato | 4 | 4 million | 500 | 59,590 crore | 39968 million |

| Jubilant FoodWorks | 4.3 | 0.58 million | 285 | 40,960 core | 27427 million |

But comparing a food delivery company to a food service company doesn’t seem fair. Zomato is the first of its kind to go public in India, so there’s no benchmark Indian company to make comparisons.

How about looking at it’s international competitors- Deliveroo and DoorDash?

| Company | Valuation (₹) | GOV (Gross Order Value)- ₹ | AOV (Average Order Value)- ₹ |

| Zomato | 59,590 crore | 29.8 billion | 407.8 |

| Deliveroo | 54,136 crore | 170 billion | 2402.5 |

| DoorDash | 4,36,496 crore | 737 billion | 2681.5 |

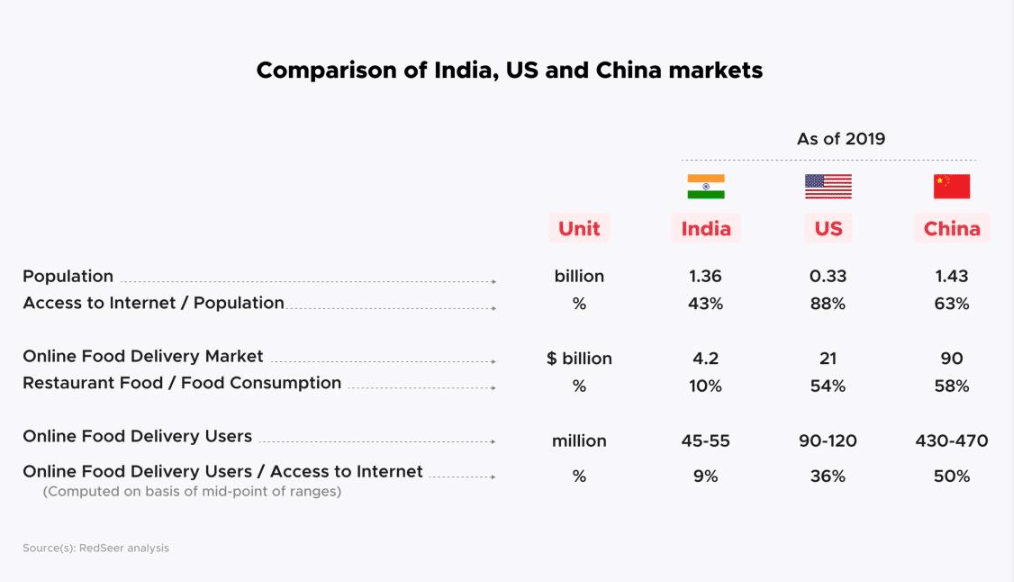

Zomato isn’t quite at DoorDash or Deliveroo’s level yet, but their figures tell a positive story. They could reach the level of other international companies. Another factor at play here is the active internet users in India. According to Zomato’s Draft Red Herring Prospectus (DRHP), around 570-600 million Indians have access to the internet, out of which 400-430 million use it daily. Further, 220-250 million use it for online services and 120-150 actually make/have made transactions on online retail platforms. From this number, only 45-55 million users order food online. While 90-120 million people in the US order food online. This puts Indian food delivery services like Swiggy and Zomato at a disadvantage. But therein lies the opportunity too. As Indian economy grows, as people’s disposable income grows and more and more people come online addressable market will grow further.

It’s the first food delivery company to go public in India. If it goes well, it will encourage other such companies in India like Swiggy.

They were faced with a new challenge during the pandemic- convincing people that food deliveries were safe and they practiced caution as people feared the virus. Eventually people started believing them. It had also been a long time since they had eaten outside food (everyone got bored of the same homemade food🥱). Soon, home deliveries became more popular as we were still under partial lockdown. Even as the second wave has calmed down, eating at home seems like a safer option. Is this the new trend? If so, their customer base isn’t going anywhere. The pandemic provided them with more customers and more business. I guess we can say that the pandemic was good for them. So good, that they’re expecting to be valued just under Rs. 60,000 crore ($8 billion)!

Price band for the offer is fixed at ₹72-76 per share (source: Mint). The issue has a fresh issue of ₹9000 crore and an offer for sale of ₹375 by its current promoter Info Edge India Ltd.

Here’s a fun fact: India loves Chinese food! Indian food services market size is pegged at about ₹4.3 trillion and Chinese cuisine accounts for more than 10% of market according to Kotak’s India Daily. About 35% of Zomato restaurant listings in the top six cities serve Chinese food. Read carefully, Chinese commands 5x pizza restaurant listings on Zomato. Next time you’re looking to open a food business, remember there are fewer pizza joints as compared to Chinese food! Chinese food accounts for 15-20% of sales on food delivery platforms. Which means the delivery market size for Chinese cuisine is approx. ₹35-40 billion! Everyone enjoys some Chinese takeout, I guess.

Swiggy also gave us an insight into some very interesting trends in 2020. Indian missed the pani puri bhaiya’s more than their relatives during lockdown. While they were unable to buy food from their neighbourhood chaat bhaiya, Swiggy delivered 2,40,088 pani puri orders!

Cooking isn’t everyone’s forte. So they chose the next best option, instant food. Swiggy’s instamart delivered 1.6 lakh packets of instant food. that can be another side play for Amazon. It has already invested in Grofer’s an online grocery store retailer).

While we should celebrate Zomato’s IPO, we should also celebrate the employment they have generated through their gig-worker-model. Anyway, if you’re looking to subscribe to Zomato’s IPO, subscriptions will open on 14 July and close on 16 July. Keep a lookout for the number retail investors who subscribe. How do you expect their IPO to go?

Leave a comment