Another one enters the market… well, almost. It’s Nykaa’s turn to go public! Falguni Nayar started the business after working as an investment banker for 18 years. Using her savings, she founded Nykaa, took the Indian e-commerce market by storm and made it a unicorn. We had written about her story as a woman entrepreneur and this is yet another success in that direction. Today, Nykaa is the leading multi-brand beauty and personal care platform in India and has a well established presence in the fashion space. They have a fresh issue of ₹5.2 billion shares and around 43 million shares are being sold as Offer for Sale.

Let’s talk about their business model. Amazon and Nykaa are both e-commerce companies. But if you dig deeper, you’ll find out that their operations are actually quite different. Nykaa has an inventory led model. This basically means, that they buy the products from the retailer and sell it to the customer at a higher price. Sort of like the shops in your locality, buy products in bulk from the manufacturers or wholesalers at lower and sell them to you at a profit.

Amazon, on the other hand, adopted a market-place model. They provide warehousing services and a platform for sellers to meet the buyers. They get their revenue from the fee the seller pays for Amazon’s services. Amazon doesn’t own most of the products on it’s website, whereas Nykaa does.

This means, when a consumer is shopping on Nykaa, they’re buying from Nykaa instead of a third-party.

Digging Deeper

| Monthly Average Unique Visitors (in millions) | Annual Unique Transacting Customers (in millions) | Ordering frequency | No. of Orders (in millions) | Average Order Value (₹) | Gross Merchandise Value (in billions) | |

| FY19 | 9.1 | 3.5 | 3.1 | 11 | 1433 | 16 |

| FY20 | 12.2 | 5.3 | 3.2 | 17 | 1448 | 25 |

| FY21 | 13.5 | 5.6 | 3.1 | 17.1 | 1963 | 34 |

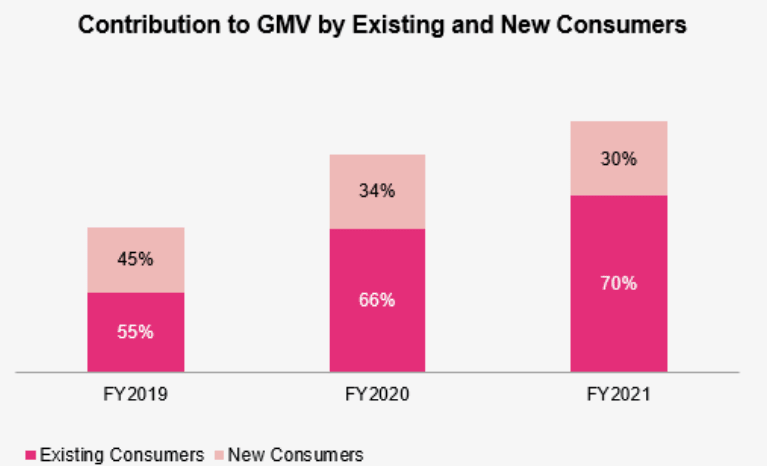

Nykaa has succeeded in getting new customers, while retaining the old ones. Approximately 70% of GMV was driven by existing customers in FY21, while the rest was driven by new customers. They have an array of services to engage with the customers and reward/incentivize their loyalty. (source: Nykaa’s DRHP)

One thing that they probably did right is that they didn’t just target their products at tier 1 cities. Instead, focus on tier 2/3 cities were helped them create a wider customer base. In fact, tier 2/3 cities account for more than 60% of their Gross Merchandise Value (GMV). (source: Nykaa’s DRHP)

Nykaa thinks this growth is because of rising disposable income and is aided by increased female workforce participation, increasing popularity and growing influence of social media, and lifestyle changes. Their growth in these cities is especially strong since their brick-and-mortar stores have limited presence. Apart from their e-commerce marketplace, they also have 73 brick-and-mortar stores located in merely 38 cities of India.

Nykaa’s GMV has more than doubled from FY19 to Fy21. Their Average Order Value also experienced a skewed growth in the past 2 years, mainly owing to the pandemic. In the Beauty and Personal Care segment, there wasn’t much change from FY19 to FY20, but this changed in FY21, when their AOV grew 35.5% as compared to the previous year. The fashion segment did even better than this, with an AOV of ₹2739 in FY21, a 300+% growth as compared to 2019 levels.

The growth in average order value in FY21 could be owing to supply chain disruptions. Pandemic related supply-chain disruptions prompted Nykaa to fulfill orders only above a certain value and increase the threshold for free shipping. The AOV was a little over ₹2,100 in the first half of FY21, and subsequently relaxed to ₹1870 in the second half of FY21 and ₹1873 in Q1 of FY22. Even then, their AOV settled above pre-Covid levels, due to an increase in products and brands on their platform and change in consumer preferences due to the pandemic, leading to higher basket (or cart🤪) sizes. (source: Nykaa’s DRHP)

.jpg)

Nykaa has a strong unit economics. Unit economics refers to the company’s revenues and cost in relation to an individual level. This is thanks to their presence in Beauty and Personal care (BPC) and fashion, both of which are high margin categories from retail perspective. Their inventory led model also provides them with a higher intake margin. Further, the company’s focus is on premium and luxury price points which have a higher profit margin. And when the customers go on revenge spending shopping sprees, they prefer to spend on luxury commodities.

But it’s not all rainbows and butterflies for Nykaa… No business comes without risks. But what are these risks?

When Nykaa started out, it was one of a kind. Now, many other platforms have emerged that are focusing on fashion and beauty e-commerce (like: Tata Cliq, Myntra, Ajio etc.). Consumers have a variety of platforms to choose from. It will be tougher for Nykaa to capture new consumers and retain the old ones as they will have a plethora of offers to choose from. They will have to work harder and possibly increase their expenditure on branding and attracting consumers.

Beauty standards are being redefined as consumers have become more aware about sustainability factors, cruelty-free products, eco-friendly products, fairness creams etc. This may pose a risk to the company unless company is able to adapt quickly to ever changing consumer preferences.

But as of now, their focus lies on their IPO and how to make it big.

Nykaa’s IPO announcement comes in the midst of a wave of companies going public in India. The bullish markets have started to settle down. Nykaa IPO may well be the barometer of investor interest in riskier, new age businesses, going public at lofty valuations.

Leave a reply to The VC funding side of Indian startups – The Echo-nomist Cancel reply